ASPINAL OF LONDON

Leading industry analysts at Bain & Co predict that 25% of high level fashion will be sold through e-commerce platforms by 2025. Farfetch states that you need both dynamics to create a successful e-commerce brand.

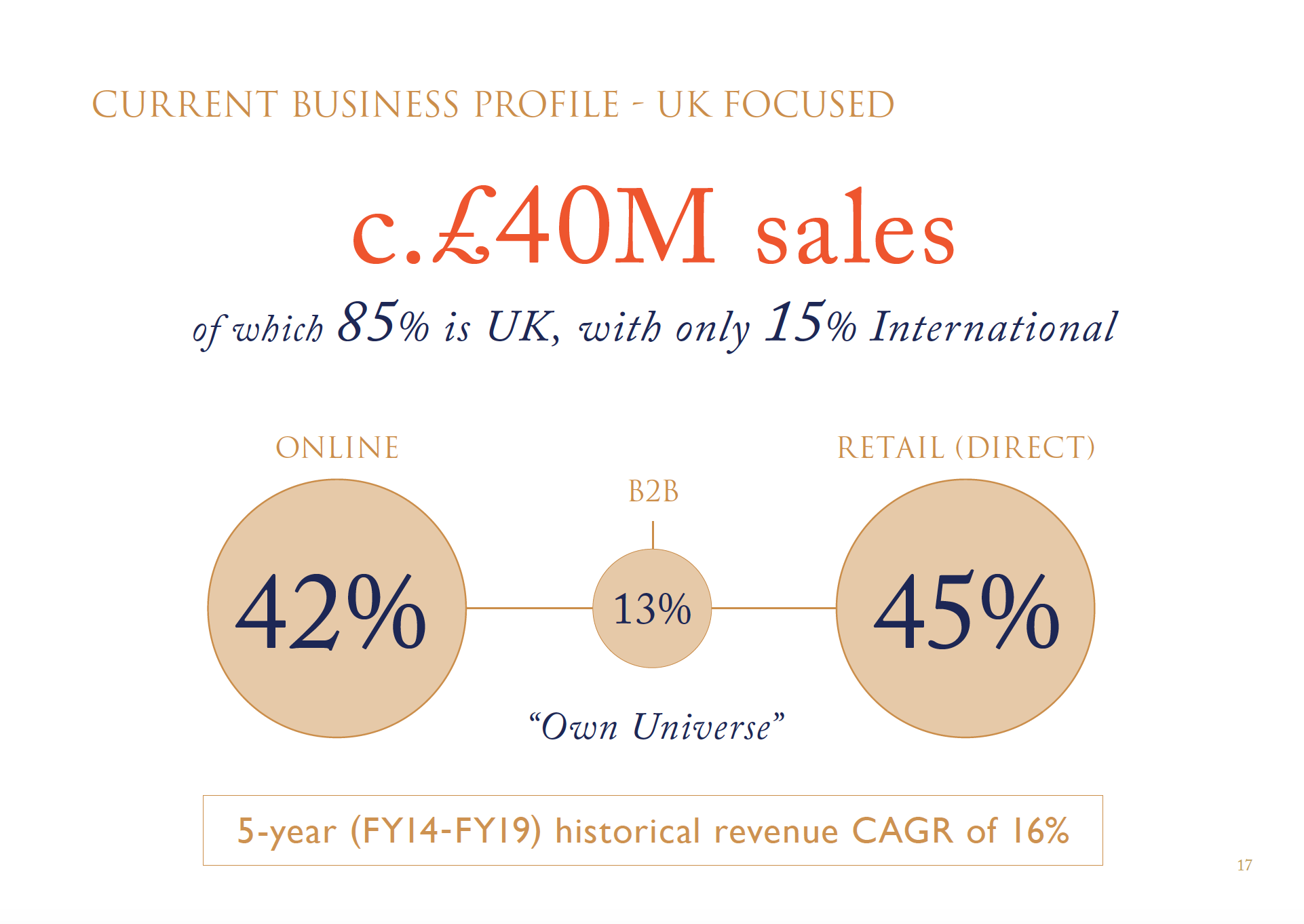

Iain Burton and his team have proven their exceptional ability to generate e-commerce sales that total 42% of all existing revenue. This is way ahead of most luxury fashion brands.

The recent openings in New York and Paris create the platform to further increase e-commerce sales. The planned new store openings in china create a further dynamic to provide significant growth.

RETAIL OVERVIEW

- Out of revenues of £35m ($42m), Aspinal achieved £15.7m ( $18.8m) of revenues in FY19 from retail stores.

- CAGR of 11% over the last three years.

- Aspinal achieved total B2B sales of £4.6m ($5.5m) in FY19.

- Increased conversion rate of customer traffic to sales last year from 12% to 18%.

E-COMMERCE OVERVIEW

- £14.7m ($17.6m) of revenues in FY19 from e-commerce platform with 77% growth over the last three years.

- 60 million newsletters sent and one million catalogues mailed last year.

- The website conversion rate has increased by 57% in the past year.

INTERNATIONAL

- New China franchise agreement signed with a plan to open 3 new retail stores over the next year, the first is due to open in October 2019. With £1.4m ($1.7m) revenues generated in FY19 from its e-commerce platform.

- £1m ($1.2m) e-commerce sales from USA and two stores with Barneys. Looking to expand in 2020 with 2 flagship stores.

- Stores in the Dubai Mall, Yass Mall and The Galleria UAE and the Avenues in Kuwait.

- Recently opened a new store in the high end Galeries Lafayette, Paris.

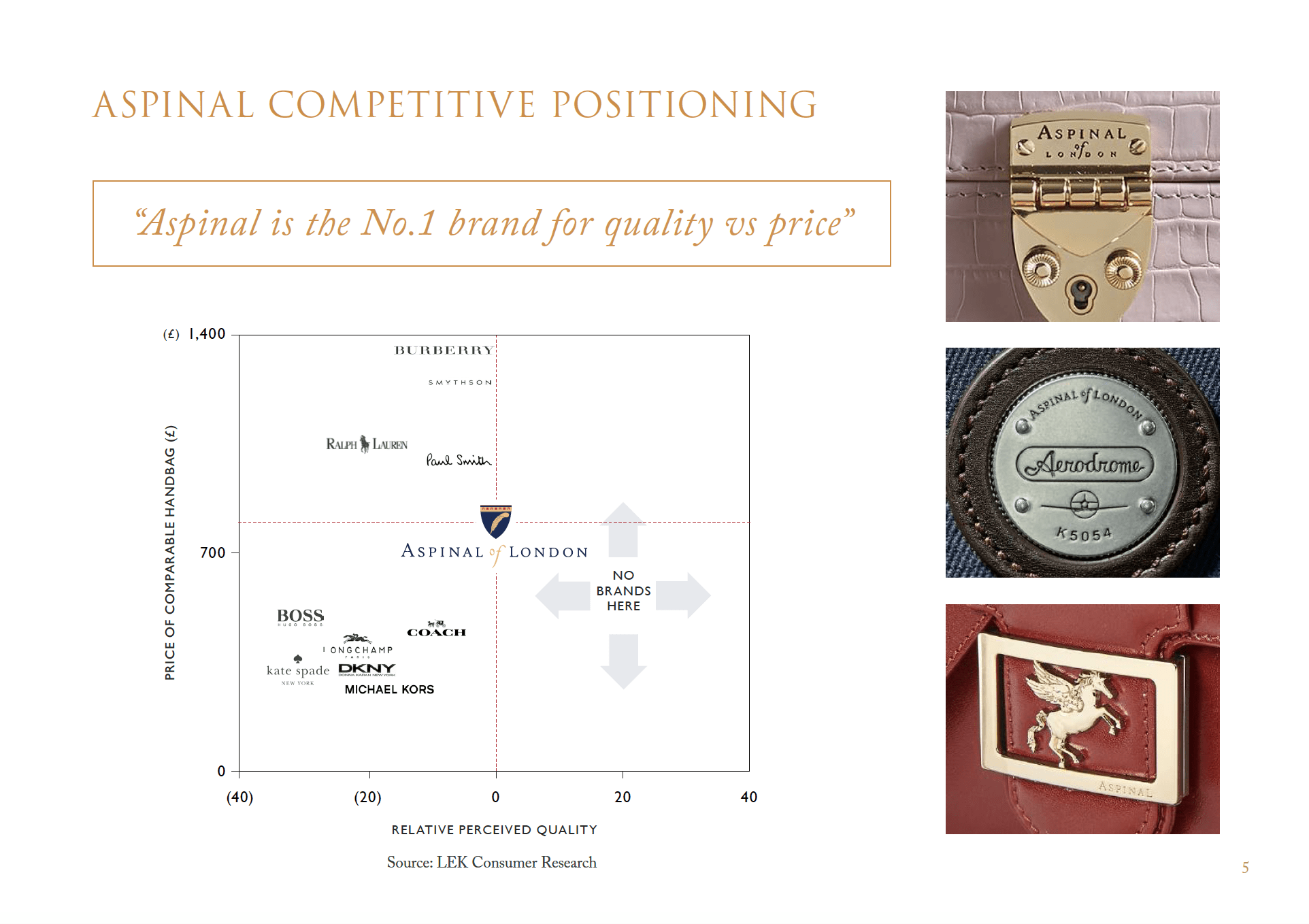

COMPETITORS

"Aspinal has the highest perceived quality of any brand up to c. £1,400 ($1,700), including more expensive luxury brands such as Burberry, Smythson and Dunhill."