OrbVest’s latest investment opportunity is a 100% tenanted Class A medical condominium located in Manalapan, New Jersey. This opportunity will provide a stable income from an established tenant with a certificate of need in place, that has signed a long-term lease. This will be our first investment opportunity with a new local property partner and sponsor, who have an extensive record as senior executives of real estate investment companies where they managed assets under management of over $2 billion.

The equity required for this investment of $2 million makes up part of the Building named Manalapan Medical Plaza, which is located at the intersection of Taylor Mills Road and Route 9 in Manalapan Township, Monmouth County, New Jersey, United States, and is available to investors from as little as $5,000.

The two-story Medical Condo of 36,653 sf is part of an 86,294 sf building that was completed in 2003 on 10.13 acres. The Medical Condo was bought by our property partner in July 2018. During the past year the partner has extended the Hackensak Meridian Health net lease for another 10 years. The tenant occupies 78,3% of the building.

The property partner is making 70% of their original investment available for OrbVest, in an effort to build a long-term relationship with us. The property partner will still hold 30% of the equity alongside the OrbVest investors.

The property is located on Route 9, which is the main North/South thoroughfare in Manalapan Township. The property is approximately 50 miles south of Midtown Manhattan and has convenient access to the New Jersey Turnpike (12.6miles) and Garden State Parkway (15.2miles).

The Major Hospitals with in a 20 mile radius are Hackensack Meridian Raritan Bay (6.5 miles, 113 beds), Hackensack Meridian Bayshore (11 miles, 148 beds), Hackensack Jersey Shore University Medical Center (21.8 miles, 779 beds), Centra State Hospital (6 miles,264 beds).

This investment opportunity should provide stable income from long-term leases and should provide capital preservation over the 5- year planned investment period.

MARKET OVERVIEW

NEW YORK - NEWARK-JERSEY CITY METRO AREA

The quality of healthcare in New Jersey continues to improve. In a recent report by the Leapfrog Group, the State moved to the top of the list from its previous ranking of 17 for the number of hospitals with class A safety ratings.

New Jersey’s aging population continues to drive the growth of medical care needs. Nearly 15% of residents in the Garden State were age 65 or older as of 2015. By 2030, that figure will approach 20%. Hackensack Meridian Health has responded to the needs of the market and its planned $714 million Hackensack University Medical Centre expansion, is possibly the biggest hospital expansion in the history of the state. Healthcare costs also continue to grow, spurring more patients to choose less costly outpatient facilities.

The aging population was a major contributor to the U.S. healthcare job growth. The sector outpaced nearly every other industry, adding more than 14% of all new jobs nationally. The health care industry continues its streak of job growth in New Jersey increasing its share of private sector jobs within the State to 16.6% over the past year. Within the sector, home health services continue to increase, and related job opportunities are expected be the among the fastest for the foreseeable future.

The medical office market is seeing good growth in rental rates, given the lack of additional new supply, compared with the real estate market as whole. The vacancy rate improved to its lowest level since mid-2009 to 4.57%.

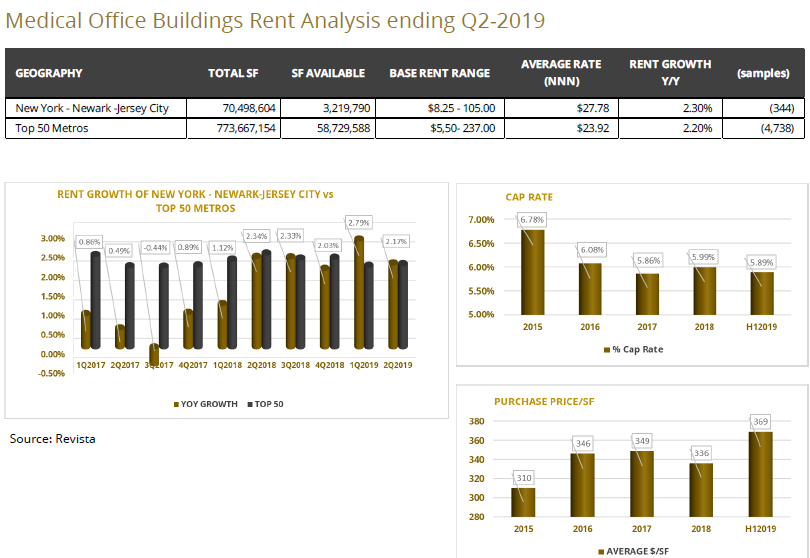

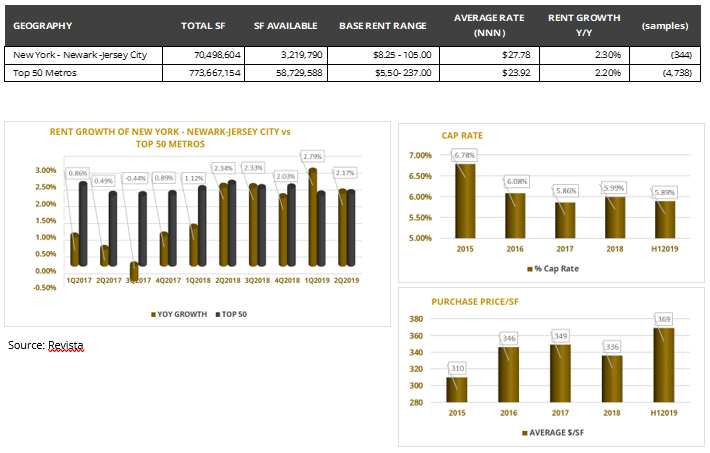

MEDICAL OFFICE BUILDING RENT ANALYSIS ENDING Q2-2019

MEDICAL OFFICE BUILDING RENT ANALYSIS ENDING Q2-2019 Tri State Area (NY, NJ, CT)

Tri State Area (NY, NJ, CT)

Population: 32,443,227 Per Capita Income: $39,917 above national average of $32,397

The Tri-State Region, commonly referred to as the greater New York (City) area, is made up of three states: New York (NY), New Jersey (NJ) and Connecticut (CT). Geographically and economically, the Tri-State encompasses areas within a commutable distance of Manhattan (by car, bus or train), or the coverage area of the broadcast television stations that operate from New York City.

With the inclusion of Manhattan in New York, Stamford and Hartford in Connecticut, and Jersey City in New Jersey, the Tri-state Region is home to the largest and most-recognized collection of high-rise office real estate, and the bulk of banking and financial institutions in the U.S. In the same manner, the inclusion of Fairfield County in Southwestern CT, Manhattan, Westchester and Long Island in NY, and a number of counties in northern NJ, cumulatively make the Tri-state Region one of the most expensive residential real estate markets in the nation.

New Jersey

Incentives remain critical as the State mulls proposals on restructured programs. Despite the challenging business climate, companies remain attracted to the state’s talent pool, accessibility and connectivity. In fact, WalletHub recently ranked New Jersey as the 12th most innovative state, and more than 1,000 technology jobs were added during 2018.

Due to high prices in walkable downtowns, millennials are expanding their geographical parameters for living preferences to areas just outside downtowns, which can only help suburban business, and consequently, the suburban office market.

Economic Growth Annualised for 2018 was 2,0%, vs US National growth of 2,9%, whilst the population of 9 million grew by 0.41% in the past year.

As of May 2019, New Jersey’s seasonally adjusted unemployment rate dropped for the second straight month to 3.8 percent, while dropping 40 basis points year over year. The total number of Nonfarm jobs has also increased by 45,900 to 4,193,800. New Jersey still trails the national unemployment rate by 20 basis points, which is 3.6 percent as of May 2019.

Manalapan Township in Monmouth County, New Jersey

The township is positioned in the western section of Monmouth County and has a land area of 30.61 square miles and completely encircles Englishtown.

Manalapan has been one of the fastest growing areas of the county, which has also been one of the fastest growing counties in the state. Most of the development in Manalapan has been detached single family homes. Route 9 is a major commercial corridor that is home to many shopping centres, national and local retailers, automobile dealerships and fast-food establishments. According to the Department of Transportation, Route 9 has an annual average daily traffic count of 59,002.

In 2000, the township had an estimated population of 33,423, an increase of 25.1% over the 1990 population estimate of 26,716. As of 2010, the township’s population was estimated at 38,872 by the U.S. Census Bureau. This is an increase of 16.3% over the past 10-year period.