The total equity in the portfolio will be $8,992,209 and therefore OrbVest will be raising $4,608,693 new equity, in order to acquire the 4 Buildings from the Medical 1 investment. The buildings are 39 A Oak Hill, 39 B Oak Hill, 39 C Oak Hill and Blairsville building.

These four buildings will add 27,500 sf Medical Office buildings to the existing 55,664 sf Medical office buildings in the Medical 3 investment bringing the total to 83,164 sf.

The Properties are disbursed throughout Atlanta in submarkets that are key to the major health systems. Johns Creek MOB and Office are situated adjacent to Piedmont Johns Creek Hospital and the Swan Building is close to the Northside Alpharetta Campus. The Newnan assets are well positioned south of Atlanta in high-growth Coweta county with convenient access to I-85 and Hwy 34.

These properties are located on or near busy thoroughfares with various amenities and excellent visibility.

The portfolio will benefit from the healthcare systems that are under mounting pressure from government and insurance companies to reduce costs and find alternatives to traditional hospital care.

As the cost of outpatient treatment is generally less than inpatient treatment, the demand for outpatient services, and buildings where those services are offered, such as these buildings, should continue to increase as the large population of Baby Boomers age and require more medical care.

ATLANTA METRO AREA

Atlanta enjoys growth in population, jobs and income. Atlanta’s economy continues to outperform the nation, and its unemployment rate is at its lowest point in more than a decade. The metro area continues to attract relocations from workers and businesses, and Atlanta is one of the nation’s fastest-growing Metropolitan Statistical Areas as a result.

This is reflected in Atlanta’s medical office market, which continues to enjoy low vacancy levels and rising rental rates, along with limited construction. Demand was very strong in Atlanta’s medical office sector during 2018, and healthcare continues to be a growth driver in the local economy.

For the past several years the Atlanta medical office market has seen steady levels of demand and limited development, which has brought vacancy down from 15% to less than 9% today. This has given rise to healthy rent growth and gained the attention of investors, who see Atlanta as a strong market in which to deploy capital. More development is likely to begin in the coming months, and the market can certainly benefit from additional product in high-demand neighbourhoods. In 2019 second half of 2019, we expect to see continuing rental growth, a rise in new construction, and a vacancy rate that should stay stable.

With global economic environment slowing, the majority of central banks have either started to cut interest rates or indicated that they will, has also encouraged the Fed to signal that they will cut interest rates potentially in the second half of 2019. This has provided for Cap Rates to stabilise and even point lower. (Increasing the value of properties)

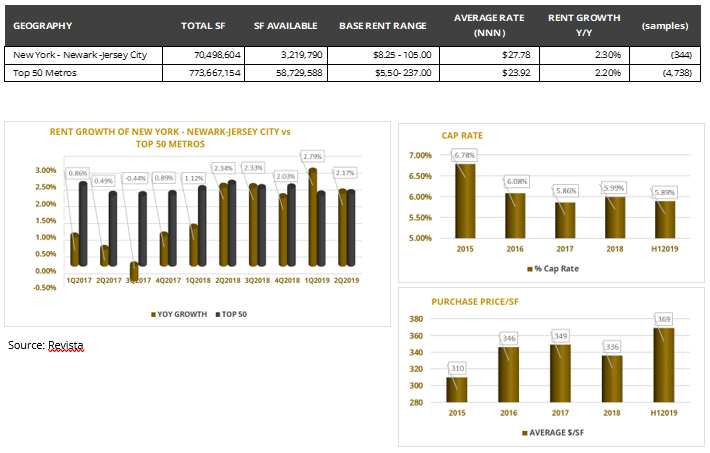

Medical Office Buildings Rent Analysis ending Q2-2019