Equity Financing in Year Two at an Up-round Valuation – Case A

Scenario: The Company raises $4M in new capital from the Convertible Notes financing, and a Series B financing occurs in the second year of the term of the Convertible Notes, where the new Series B investor(s) contribute $12M in new equity capital, with a pre-money valuation of $36M1.

To determine if such Series B financing would be classified as a “Subsequent Equity Financing”, we would add the $4M to the $12M and therefore the total financing between the Convertible Notes financing and the Series B financing would be $16M, and greater than the $15M threshold for a Subsequent Equity Financing conversion.

Next, we would determine how the Convertible Notes would convert as follows:

Conversion Calculation: i. At a pre-money valuation of $36M1, the new equity shares would be valued at $14.33 per share based on a fully diluted number of shares of 2,512,0502.

ii. Since the Subsequent Equity Financing happens in the second year of the term of the Convertible Notes, the Convertible Notes would convert at 90% of the share price for the new investor(s), or $12.90 per share ($14.33 * 90%).

1 Since the financing occurs in the 2nd year, a projection of $6M in annual revenues at 6X such revenues was used for the premoney valuation calculation.

2 Total number of shares includes a 15% option pool allocation.

Equity Financing in Year Two at an Up-round Valuation – Case B

Scenario: The Company raises $4M in new capital from the Convertible Notes financing, with $3M from existing investors and $1M from new investors. All other facts are the same as Scenario 1 above.

To determine if such Series B financing would be classified as a “Subsequent Equity Financing”, we would add the $4M to the $12M and therefore the total financing between the Convertible Notes financing and the Series B financing would be $16M, and greater than the $15M threshold for a Subsequent Equity Financing conversion.

The split of the new capital between existing and new investors in the Convertible Note Financing does not affect the calculation of whether the Subsequent Equity Financing conversion threshold of $15M is met.

Conversion Calculation: Same result as in Case A above.

Equity Financing in Year Four at an Up Round Valuation

Scenario: The Company raises $4M in new capital from the Convertible Notes financing, and a Series B financing occurs in the fourth year of the term of the Convertible Notes, where the new Series B investor(s) contribute $12M in new equity capital, with a pre-money valuation of $36M3.

To determine if such Series B financing would be classified as a “Subsequent Equity Financing”, we would add the $4M to the $12M and therefore the total financing between the Convertible Notes financing and the Series B financing would be $16M, and greater than the $15M threshold for a Subsequent Equity Financing conversion.

Next, we would determine how the Convertible Notes would convert as follows:

Conversion Calculation: i. At a pre-money valuation of $36M, the new equity shares would be valued at $14.33 per share based on a fully diluted number of shares of 2,512,0502.

ii. Since the Subsequent Equity Financing happens in the fourth year of the term of the Convertible Notes, the Convertible Notes would convert at 80% of the share price for the new investor(s), or $11.46 per share ($14.33 * 80%).

Equity Financing in Year One at a Flat Valuation

Scenario: The Company raises $5M in new capital from the Convertible Notes, and a Series B financing occurs within the first year of the term of the Convertible Notes, where the new Series B investor(s) contribute $10M in new equity capital, with a pre-money valuation of $24M4

To determine if such Series B financing would be classified as a “Subsequent Equity Financing”, we would add the $5M to the $10M and therefore the total financing between the Convertible Notes financing and the Series B financing would be $15M, and equal to the $15M threshold for a Subsequent Equity Financing conversion.

Next, we would determine how the Convertible Notes would convert as follows:

Conversion Calculation: i. At a pre-money valuation of $24M, the new equity shares would be valued at $9.22 per share based on a fully diluted number of shares of 2,601,0622.

ii. Since the Subsequent Equity Financing happens in the first year of the term of the Convertible Notes, the Convertible Notes would convert at 100% of the share price for the new investor(s), or $9.22 per share.

iii. Note: In this scenario the new shares would be priced at approximately the same price per share as the Series A financing of $9.16.

3 Although this scenario doesn’t happen until year 4, the same $36M pre-money valuation from scenario 1 was used for consistency of comparison.

4 Since the financing occurs within the first year, a projection of $4M in annual revenues at 6X was used for the pre-money valuation calculation.

Equity Financing in Year One at a Down Round Valuation

Scenario: The Company raises $5M in new capital from the Convertible Notes, and a Series B financing occurs within the first year of the term of the Convertible Notes, where the new Series B investor(s) contribute $10M in new equity capital, with a pre-money valuation of $20M.

To determine if such Series B financing would be classified as a “Subsequent Equity Financing”, we would add the $5M to the $10M and therefore the total financing between the Convertible Notes financing and the Series B financing would be $15M, and equal to the $15M threshold for a Subsequent Equity Financing conversion.

Next, we would determine how the Convertible Notes would convert as follows:

Conversion Calculation: i. At a pre-money valuation of $20M, the new equity shares would be valued at $7.49 per share based on a fully diluted number of shares of 2,671,5472.

ii. Since the Subsequent Equity Financing happens in the first year of the term of the Convertible Notes, the Convertible Notes would convert at 100% of the share price for the new investor(s), or $7.49 per share.

iii. Note: In this scenario the new shares would be priced at less than the Series A financing price per share of $9.16.

Sale of Company for $40M - true “Change of Control” (COC) as Defined

Scenario: The Company raises $6M in new capital from the Convertible Notes from existing investors. In the third year of the term of the Convertible Notes, a third party offers to acquire all of the issued and outstanding equity of the Company (an “Acquisition”) for $40M, which would equate to $20.48 per share on a fully diluted number of shares of 1,953,2355.

Conversion Calculation: i. All equity shares of the company would be purchased by the acquiror in the Acquisition.

ii. Since this would be is a COC as defined, each individual Convertible Note holder would have the option to either (i) get repaid principal and accrued interest on their Note in full or (ii) convert the applicable principal and accrued interest into equity shares of the Company at the appropriate conversion price and then receive the amount of cash per share via the Acquisition.

iii. Since the Acquisition happens in the third year of the term of the Convertible Notes, each individual Note Holder who chooses to convert would convert their Convertible Notes into equity shares at 150% of the Series A post money valuation ($14.5M * 150% = $21.75M), which would equate to $11.14 per share.

5 In the Acquisition scenario there would be no increase in the Option pool, therefore a reduced number of total shares is used for the fully diluted calculation.

Technical “Change of Control”, But Not A “Change of Control” as Defined

Scenario: The Company raises $4M in new capital from the Convertible Notes from existing investors, and a Series B financing occurs in the third year of the term of the Convertible Notes, where the new Series B investor(s) contributes $40M in new equity capital, with a pre-money valuation of $30M (March 2025).

The new investment exceeds the threshold for a Subsequent Equity Financing conversion.

Conversion Calculation: i. The above scenario would result in the new Series B investor(s) owning more than 51% of the fully diluted shares of the Company, therefore this technically could be considered a change of control.

However, this transaction would not trigger a Change of Control conversion event, as it would not meet the definition of “Change of Control” agreed in the Convertible Notes.

Therefore, this scenario would result in a conversion under the Subsequent Equity Financing calculation.

ii. At a pre-money valuation of $30M, the new equity shares would be valued at $9.55 per share based on a fully diluted number of shares of 3,142,9202.

iii. Since the new investor transaction happens in March 2025, which is in the third year of the term of the Convertible Notes, the Convertible Note Holders can convert at a price that is 85% of the share price for the new investor, or $8.12 per share ($9.55 * 85%).

What Are the Risks Associated with the Company?

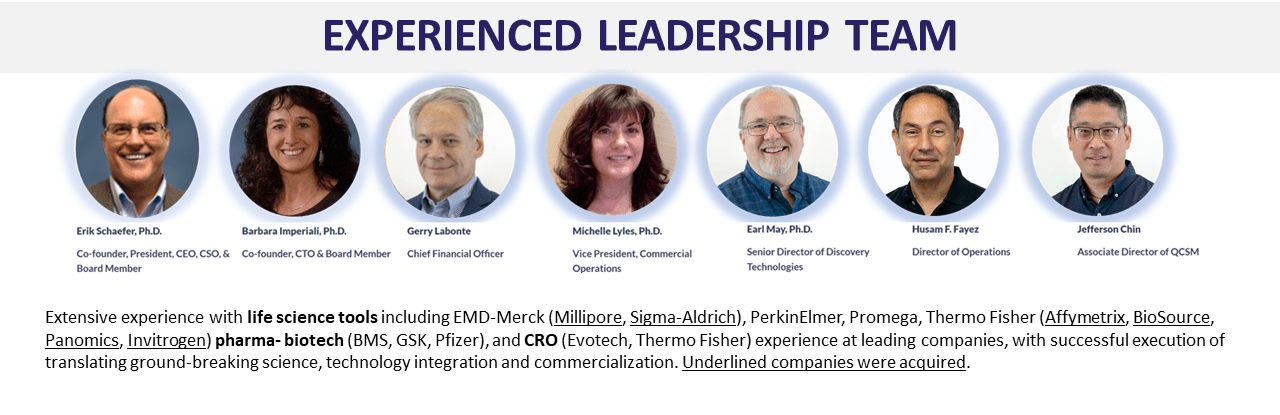

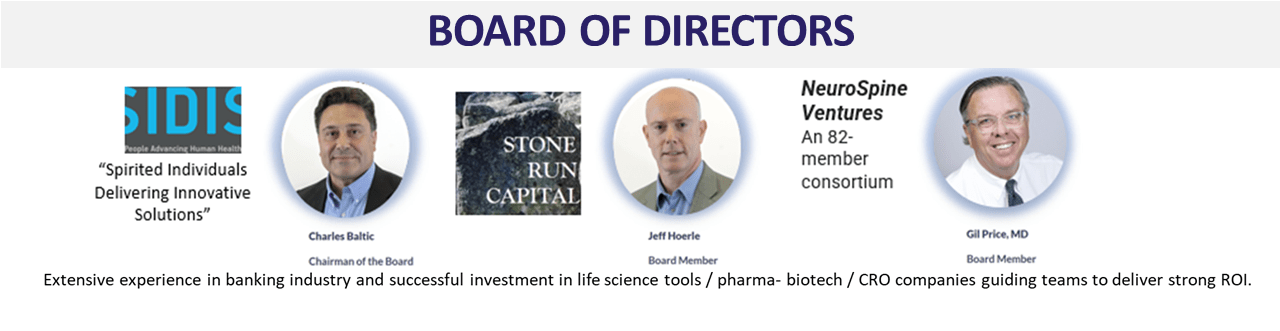

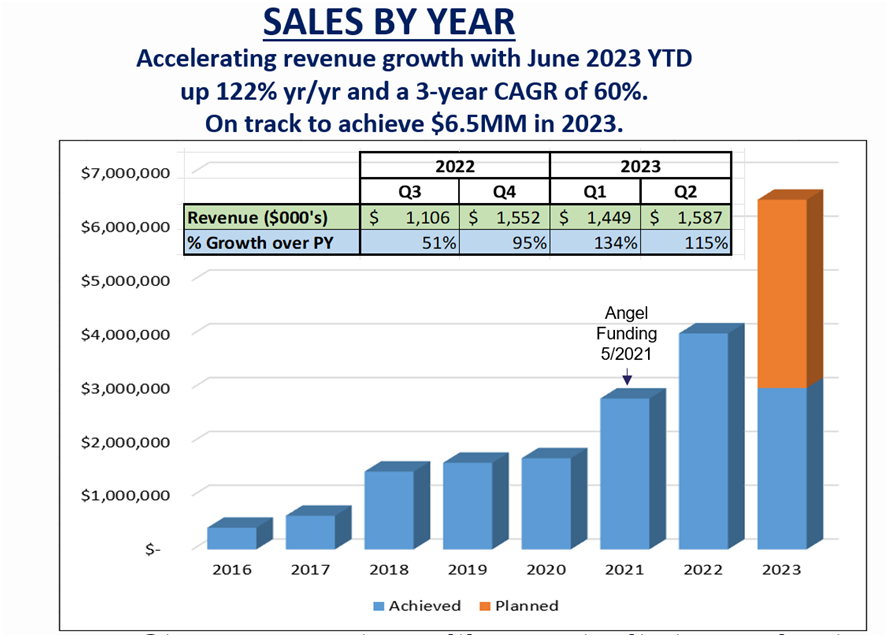

The Company currently has minimal risks. Indeed, we have systematically built anA-team and demonstrated strong execution with accelerating revenues since ourSeries A fundraiseof $4.5 million in May 2021. At that time, the company had only 5 employees and achieved $2.8 in revenue. The Management Team of the Company was almost non-existent except for Erik Schaefer, the CEO.

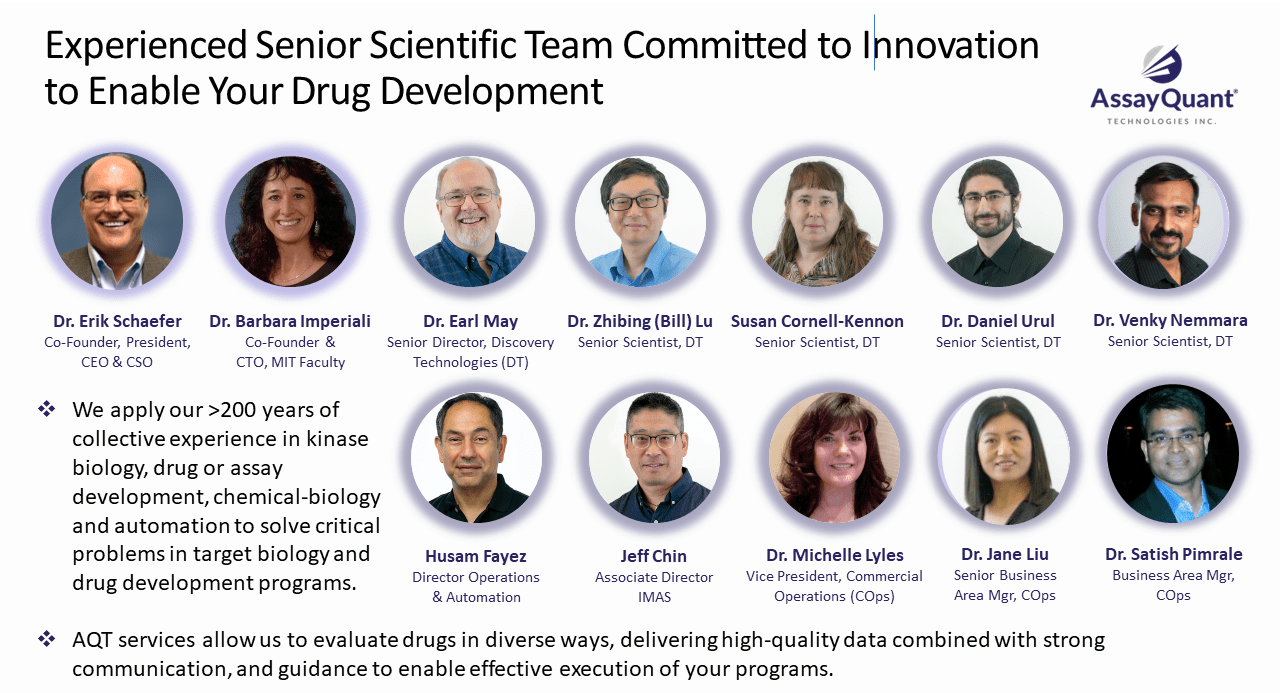

Since the Series A Fundraise, we have grown to 27 employees with a full Leadership/ Senior Management Team and a solid infrastructure that includes:

- i) Commercial Operations with a lean but highly effective Sales & Marketingteam (7 FTEs) under the leadership of Michelle Lyles, Ph.D.,

- ii) Discovery Technologies managing the custom services of the Company under the leadership of Earl May, Ph.D.,

- iii) Inventory Management & Automated Services (IMAS)under the leadership of Jefferson Chin, and

- iv) Finance (also Facilities, Human Resources & Project Management) under the leadership of Gerry Labonte, CFO.We also expanded from 1,500 to 9,500 sq ft and have added instrumentation (automation and microplate readers) to fuel our growth. As of June 2023, our sales were up ~2-fold year-over-year and our 3-year revenue Compounded Annual Growth Rate (CAGR)was 60%. We are on track to achieve theannual revenue goal for 2023 of $6.5 million (see further detail regarding revenue in question 2 below).

We have in place a Risk Matrix for each department that includes assessment of Impact and Probability of Occurrence, both before and after mitigations. The main risks we face are appropriate for a growth company at our stage. This includes continuing to effectively balance supply and demand for Q4 2023 and 2024 & 2025, so that we remain on track for revenue growth and operational efficiency/cash burn until we are profitable, which istowards the end of 2025. We offer both catalog products (>70% gross margin with minimal optimization so far) and custom testing services, which maximizes our ability to serve our customers. An active area of focus is taking out cost with our Custom Testing Services so that we increase gross margins to >60%, as discussed in question 6 below.

Where Do You See Sales Trending in the Next 12 to 24 Months?

As of June 2023, YTD revenue is up 122% over prior year for the same period, and AQT has had growth for the last 3-yearswith a CAGR of 60%. We have projected 74% & 80% growth for 2024 & 2025, respectively.

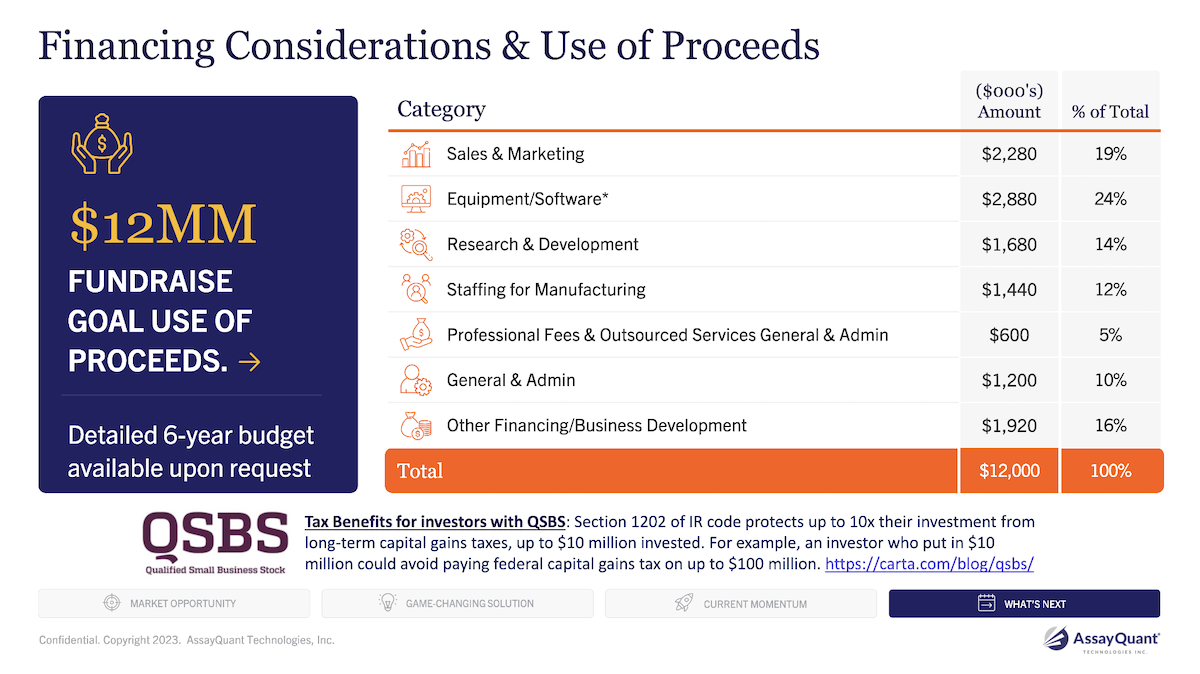

What Is the Best Use for Cash on the Company's Balance Sheet?

The company is reserving current cash to support the burn rate for employees, equipment and operational costs.

With the cash to be obtained through this fund raise, the priority items are as follows:

- i) Sales & Marketing cost to include key hires for sales, and next version of the website with eCommerce,

- ii) Research & Development for an R&D Director to coordinate the expanded portfolio of products and services, including new fluorophore derivatives and selective sensor peptide development for analysis of cell & tissue lysates,

- iii) Manufacturing & Custom Testing where we are integrating full automation to increase capacity & margins, for which additional equipment & software will be purchased.

How Does the Company Plan to Raise Capital in Order to Fund Future Growth?

The company is in the process of raising capital under a Convertible Debt Structure while also raising equity capital as a Series B Round. Both of these mechanisms for raising capital are being coordinated through an agency. The Company has raised $4.4 million via the current Convertible Debt offering mainly through its current investors (86%) and other close relationships.

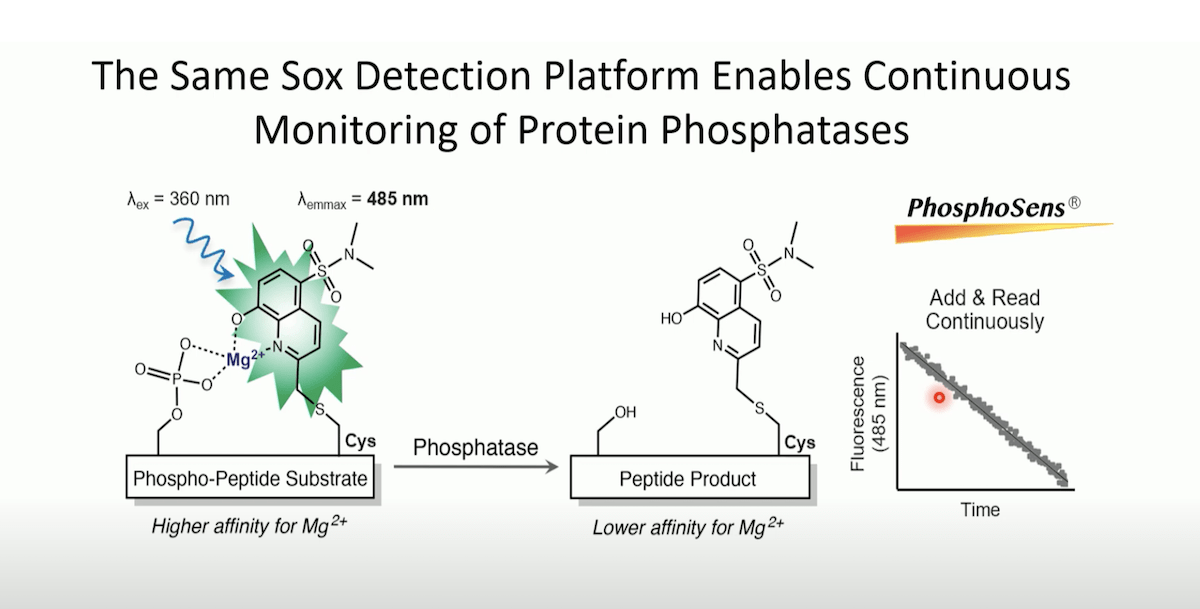

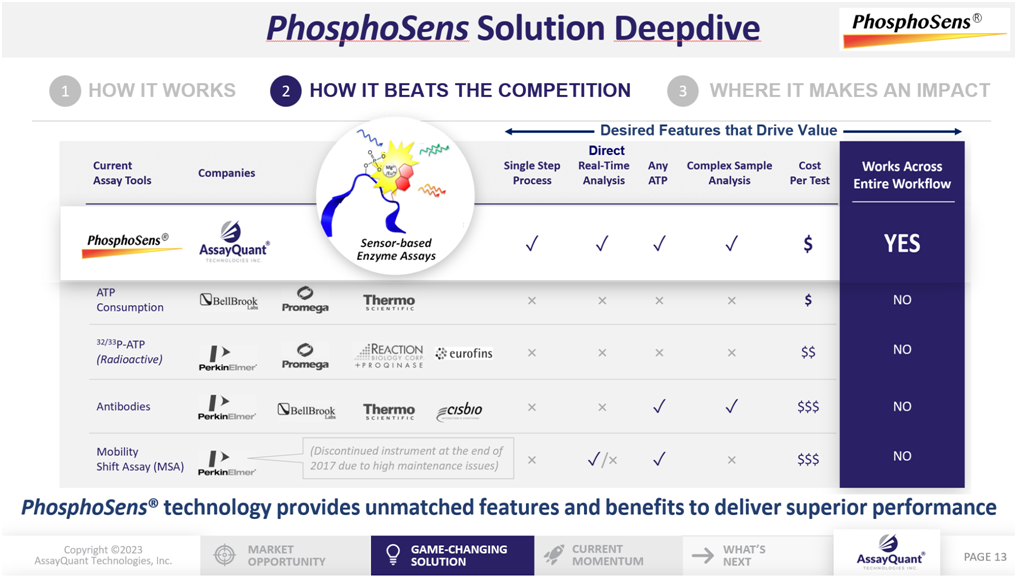

Who Are the Emerging Competitors in the Industry in Which You Operate?

Despite the large ($1 billion+ market size) and high amount of activity in the kinase inhibitor space (as demonstrated by large IPO’s or Series A/B/C’s, increasing approvals by the FDA and other agencies, and several market reports forecasting inhibitor sales to be ~$160 billion by 2032), there has been very little innovation with kinase assay technologies in the last 20 years. The PhosphoSens platform from AssayQuant incorporates innovative technology out of MIT (invented by a co-founder) that provide a simple and powerful approach that is enabling improved drugs to be created faster and at reduced cost.

The strong collection of features and benefits with PhosphoSens technology is unmatched and is allowing us to both take and create market share. The competitor view is shown below:

What Part of the Business Is Giving You the Most Trouble Now?

We currently provide a custom service for full kinome profiling with >400 wild-type kinases, which is market leading from a menu perspective alone. Moreover, this service is performed kinetically with our PhosphoSens platform, providing higher accuracy and precision and greater information about the functionality of both the kinase targets and the drug.

We also run this at low or high ATP, where the latter provides a physiological correlate, and we are the only company to offer this across >400 targets with a single platform based on functional activity measurements. Initially, this profiling service was set up and performed manually to demonstrate feasibility and market adoption (we have shown both). In 2023 we have implemented the first phase of full automation with robotics purchased with the Series A funding. To meet demand and systematically take out cost to increase gross margins to >60%, we have several continuous improvement projects ongoing across the company.

Next steps are focused on integrating the Scigilian database and the Arktic freezer sample retrieval system for complete control of all reagents, data analysis and report generation. Another initiative is to begin purchasing a significant amount of bulk kinases to obtain much lower pricing, which is critical since our primary vendor for kinases increased cost to usby 1.5-foldearly in 2023 (this was a combination of reduced discount and increased list price).

We have pushed back on pricing and will receive an additional discount with bulk purchases.We are charging a premium for the profiling service relative to the market, so our cost reduction initiatives are high priority, and these efforts are proceeding as planned. Importantly, we have validated market demand for our Profiling Service and revenue has already increased toapprox. $700K or 23% of total sales in the first half of 2023.

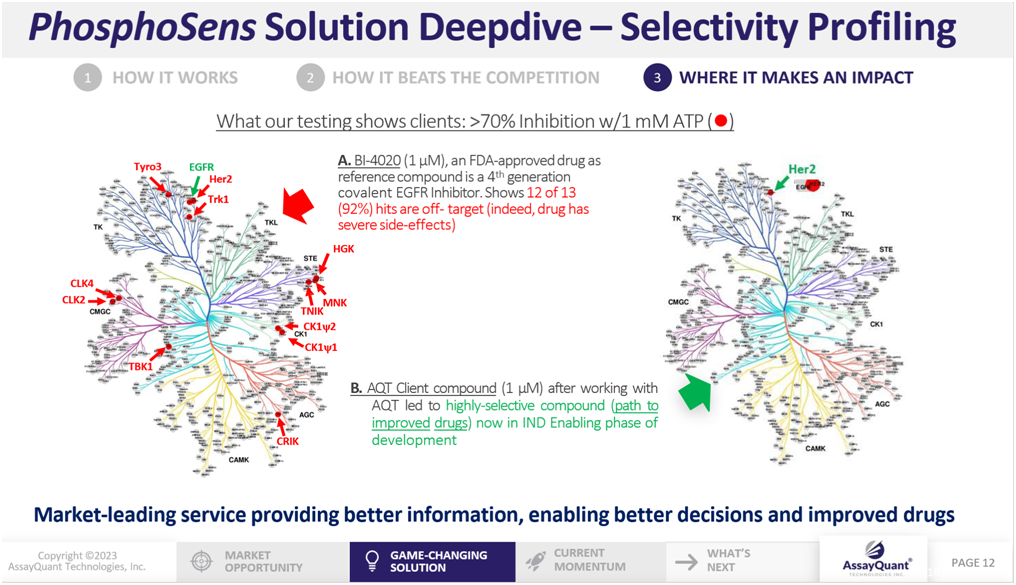

Our profiling service informs clients about the specificity of their compounds. Historically, even many FDA-approved kinase inhibitors are quite “dirty”, meaning that that they exhibit many off-target liabilities that contribute to the side-effects of the drug (see figure below on left side).

In contrast, customers working with us are able to create highly selective drugs (see figure below on right side).

How Close Is Wall Street in Terms of Estimating Your Company's Earnings Results?

Not applicable, as we are a privately held company and earning results are not made public.

What is the company's reputation for services, products?

We have accelerating sales fueled by repeat orders and new customers and both reflect the increasingly compelling reputation we are building. This includes outstanding technical support and a marketing focus that is “Science First”, thereby delivering a streamlined and informative message that resonates with our customers. When clients move from one company to another, they bring their loyalty to us with them. We have focused on delivering quality and essentially have no complaints.

Are there any complaints on file against the company with BBB or a local consumer protection agency?

No, the company has never had a lawsuit against it, nor any complaints with any agency.