About CCC

US paper companies are mainly tooled to use virgin pulp. The recycled paper pulp market is dominated by Chinese companies. Most US companies lack the expertise and critical relationships to bridge the critical gap between the US and China to transition the industry back to the US.

There is a misperception that the large US trash companies (as opposed to paper companies) are recycling companies. That is not entirely true. The business model for the largest US trash companies is to collect, sort and then dump or sell to middlemen that often deliver to Chinese paper companies in Southeast Asia for initial processing, which is then shipped to China to be turned into finished recycle products, of which some is shipped back to the US. This represents up to 45% of all US recycled boxes.

It is a clubby wholesale insider’s market that requires long standing and deep relationships earned by performing over many years to obtain supply from US suppliers, and large factory customers that buy only from established sellers. If you do not fit that profile, you will not be able to enter the market.

CCC has solved this problem in its partnership with Harbor Green Recycling LLC (HGR), an expert in the US-China recycled box and paper trade. Its principals have developed a track record of performance since 2014, having recycled over 1 billion boxes. HGR has a positive name in this market. HGR is the exclusive service provider in a JV relationship wherein HGR sources the feedstock for CCC, and then buys 100% of CCC’s recycled paper pulp, locking in a high rate of return for CCC franchisees.

CCC will initially sell some recycled paper pulp back to China during the critical transition phase making CCC quickly cash flow positive, but keep increasing amounts of the pulp in the US to manufacture into finished recycled paper products for the US market. Thus, CCC will capture the highest value-added ROI portions of the recycling continuum while propagating substantial environmental benefits.

Suppliers in the US are eager for and supportive of HGR to expand US recycling capacity via CCC and are willing to sign long-term contracts for very large quantities of boxes and paper as they often must pay punitive landfill tipping fees for material that is supposed to be recycled, often by law.

On the customer side, to operate in this wholesale market requires deep relationships and understanding of the China market which most US companies do not have. CCC has this through its relationship with HGR which will be contracted to operate operations, procurement, sales, and most operational aspects, receiving years of hard earned technical expertise others lack.

The next pain point is access to licenses in the US. CCC through HGR has access to current licenses in California, and is ready to pull licenses in Nevada, Arizona, Utah, Colorado, and other Western States, having spent over 5 years developing critical local relationships such as the Governor of Nevada and the Treasurer of California. This is a sea-change from when the current supply was constructed 30 years ago. Most in the US were simply happy to see the trash disappear overseas. Those days are over, and CCC is at the forefront of the new wave of onshoring and environmentalism. CCC has a five-year head-start over many competitors. Plus, our smaller clean plant strategy minimizes local opposition.

Logistics is another pain point as the recycling business requires moving large amounts of used boxes around the US and internationally. HGR is providing a complete logistics package to CCC, managing all the logistics through its dedicated logistics partner CTC Logistics, a highly experienced logistics company expert in moving large quantities of boxes and paper for decades.

On the technology side, HGR is providing CCC with the latest new patented equipment from China, the world’s largest and most cost-efficient supplier of such equipment. CCC equipment will be the latest generation of new recycling equipment which is 20% more efficient by eliminating most wastage of current equipment. There is little technology risk in CCC’s strategy.

The final barrier to entry is funding, which is in short supply. US Climate Czar John Kerry highlighted the money problem at the WEF in Davos in 2022 and challenged everyone to do more, now. It is easy to see why if you listen to the Harvard Business Review which found that most ESG investments have underperformed and do not deliver better ESG results.

The problem is not lack of money, it is lack of performance and verifiable environmental benefits. In fact, demand for socially responsible investments continues to grow according to McKinsey & Co.

CCC has solved this problem with its unique strategy which should provide high returns on a risk-controlled basis while delivering AAA, verifiable, environmental benefits.

| Project Title | Document Title | Action |

|---|---|---|

| Circle Climate Corporation | PPM |

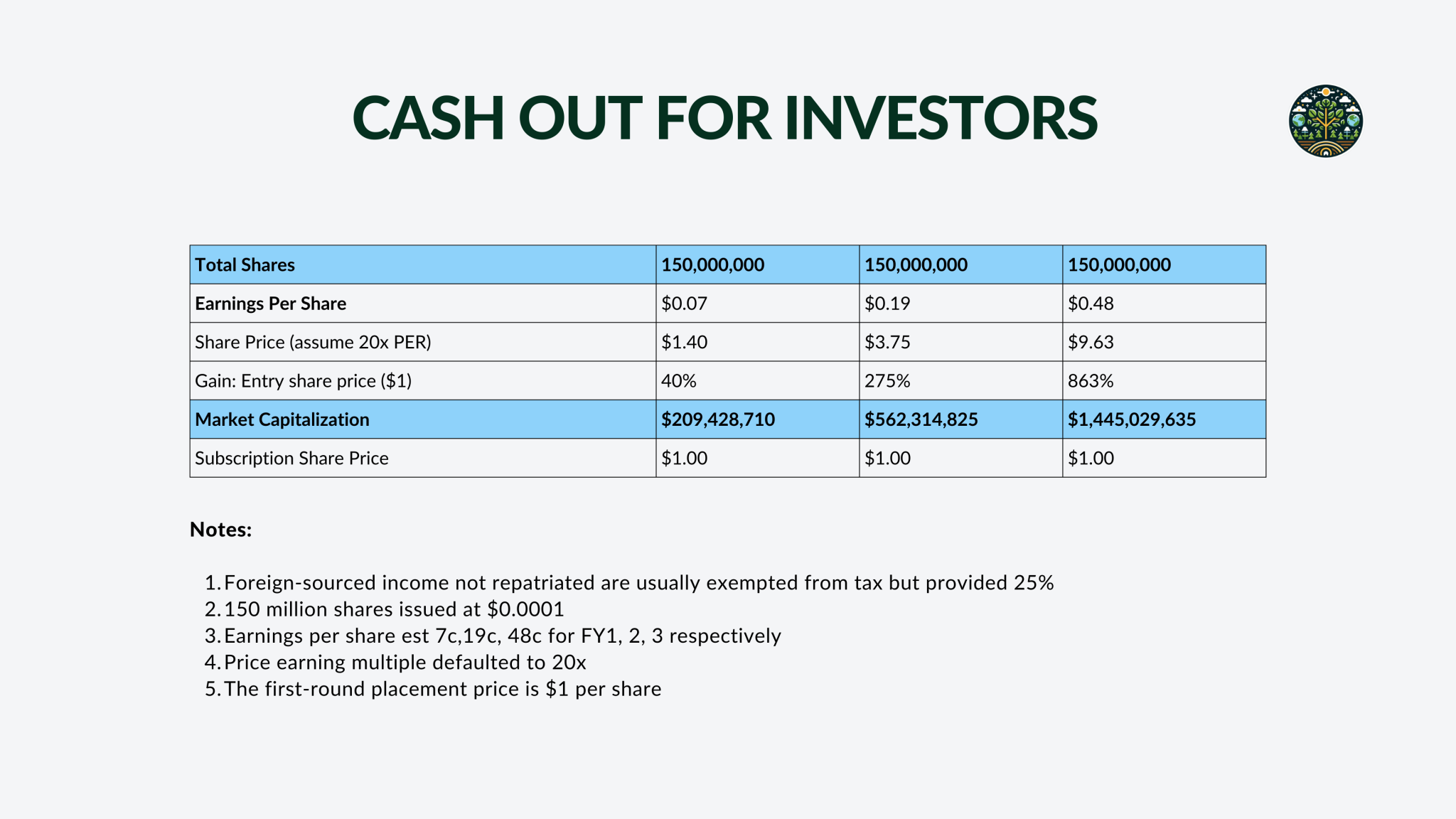

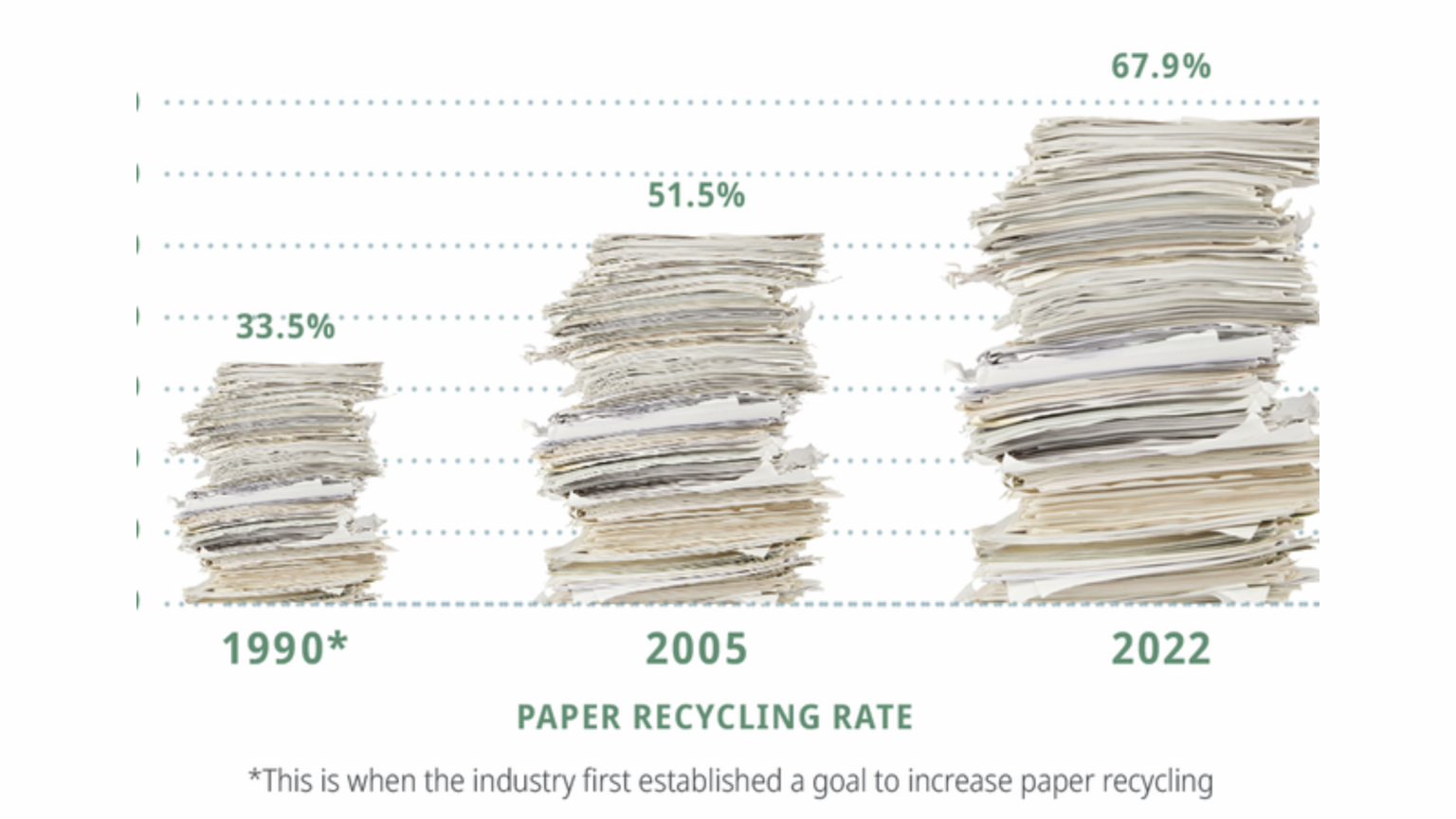

According to the American Forest & Paper Association the US consumes around 66 million tons of paper and paperboard per year, of which 68% is currently being recycled, or 45 million tons per year.

According to the American Forest & Paper Association the US consumes around 66 million tons of paper and paperboard per year, of which 68% is currently being recycled, or 45 million tons per year.

There simply is not enough box and paper plant recycling capacity in the US.

Sixty-three percent (63%) of all US boxes and paper are either not being recycled or being shipped overseas for recycling, something completely unacceptable in today’s world struggling to fight climate change and environmental degradation.

The challenge is how to make it profitable enough to attract the needed capital to build out the needed plants. And, to make it clean and quiet enough so that politically those plants can be built locally instead of shipping half-way around the world for processing.

Breaking it down, 33% of all US boxes and paper collected by US trash companies are now being dumped in scarce landfills.

Of the remaining 67% that is recycled, 45% is unnecessarily being shipped overseas for processing rather than in the US, primarily in Southeast Asia. This represents 30% of all US boxes and paper consumed per year (33%+30%=63% of all paper and boxes consumed in the US need US based recycling capacity).

This is causing more trees to be chopped down while the best scientific research from MIT and elsewhere has concluded that the most cost-effective, immediate, and scalable action humans can take to ameliorate the negative impacts of climate change is to simply stop destroying the trees that currently exist.,

The US Forest Service determined, “Trees are climate change, carbon storage heroes.” The Nature Conservancy says, “Our greatest advances in carbon-capture technology don’t hold a candle to trees in terms of efficiency or cost, and the US Department of Agriculture has determined that “one tree takes in 48 pounds of carbon per year.”

For the 45% of boxes shipped halfway around the world for processing, around 50% of the environmental benefits of recycling are offset by the extra shipping and logistics.

Further, CCC is working with AAA Carbon Offsets (a division of Seagate Global Resources LLC and owner of HGR) to obtain its AAA rating for CCC’s carbon offsets to help monetize them. This potential income is not included in CCC’s pro forma income projections due to the current uncertainty in the private carbon offset market, and are unneeded for CCC’s business model. However, we believe that the current carbon offset market setbacks will only make CCC’s carbon offsets more sought after and valuable in the future.

Market experts at Bloomberg, Morgan Stanley, and others forecast that the price of carbon offsets could rise as much as 3,000% by 2030., That may be optimistic, but even at lower price points, income from carbon offsets for CCC could be very substantial over time. Investing in CCC is thus a free option on the carbon offset market while providing a superior risk rate of return.

Subject to negotiation, CCC may allocate AAA Carbon Offsets for no cost to investors worth more than their actual investment (depending on market prices and assumptions), making an investment in CCC essentially free.

Also, our AAA Carbon Offsets may be combined with other products or tree planting strategies to create new compelling hybrid products.

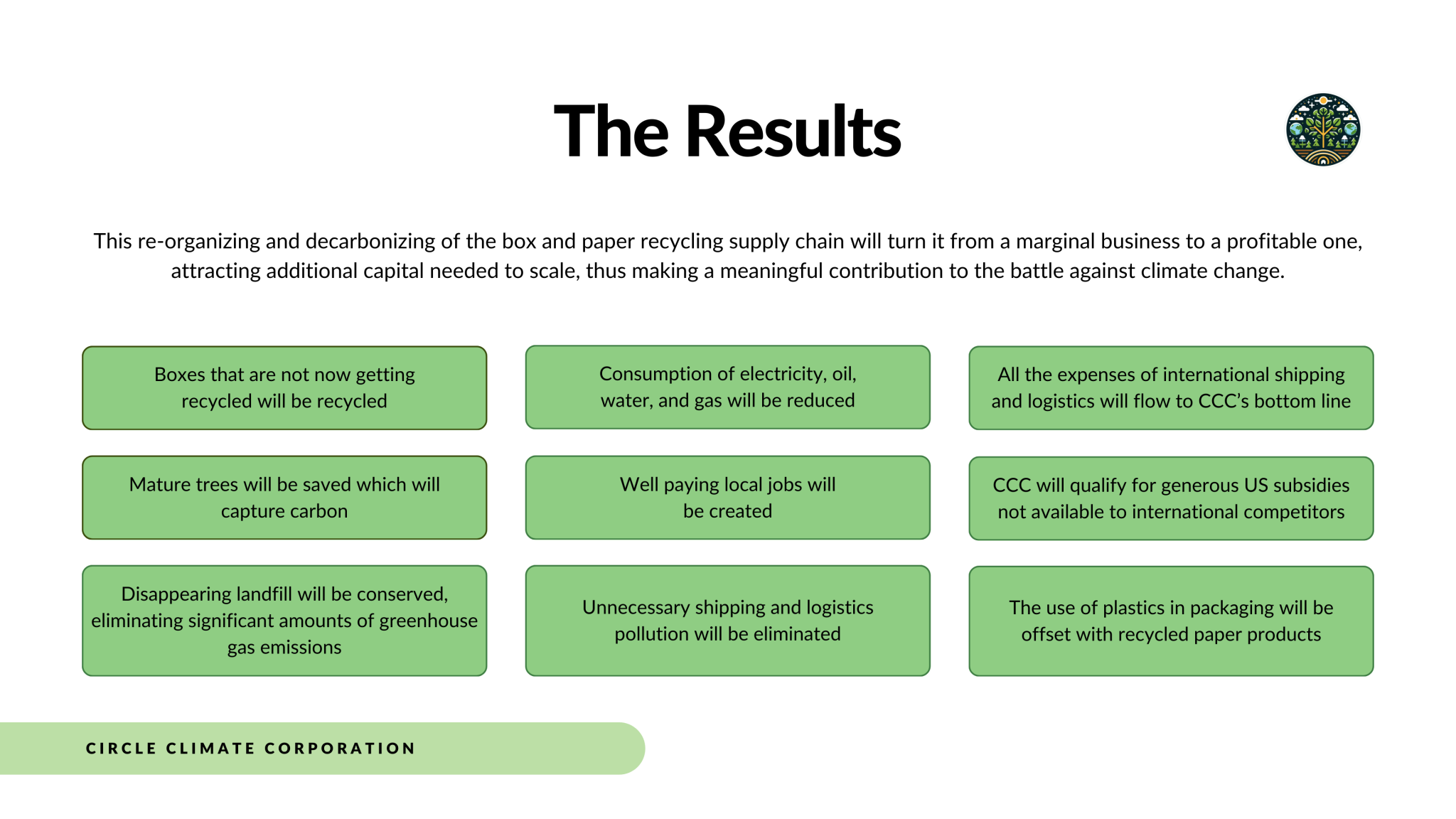

CCC’s solution offers numerous benefits, including:

Several barriers hinder entry into the recycling industry. US paper companies primarily use virgin pulp, while the recycled paper pulp market is dominated by Chinese companies. Additionally, there’s a misconception that large US trash companies handle recycling, but their business model often involves collecting, sorting, and then exporting materials overseas for processing.

Entering the recycling market requires long-standing relationships and expertise, making it challenging for newcomers to navigate. However, CCC has addressed these barriers through a partnership with Harbor Green Recycling LLC (HGR), which brings expertise and a positive reputation in the US-China recycled box and paper trade.

Investment Summary

Documents

Contact Investor Relations