About ABC

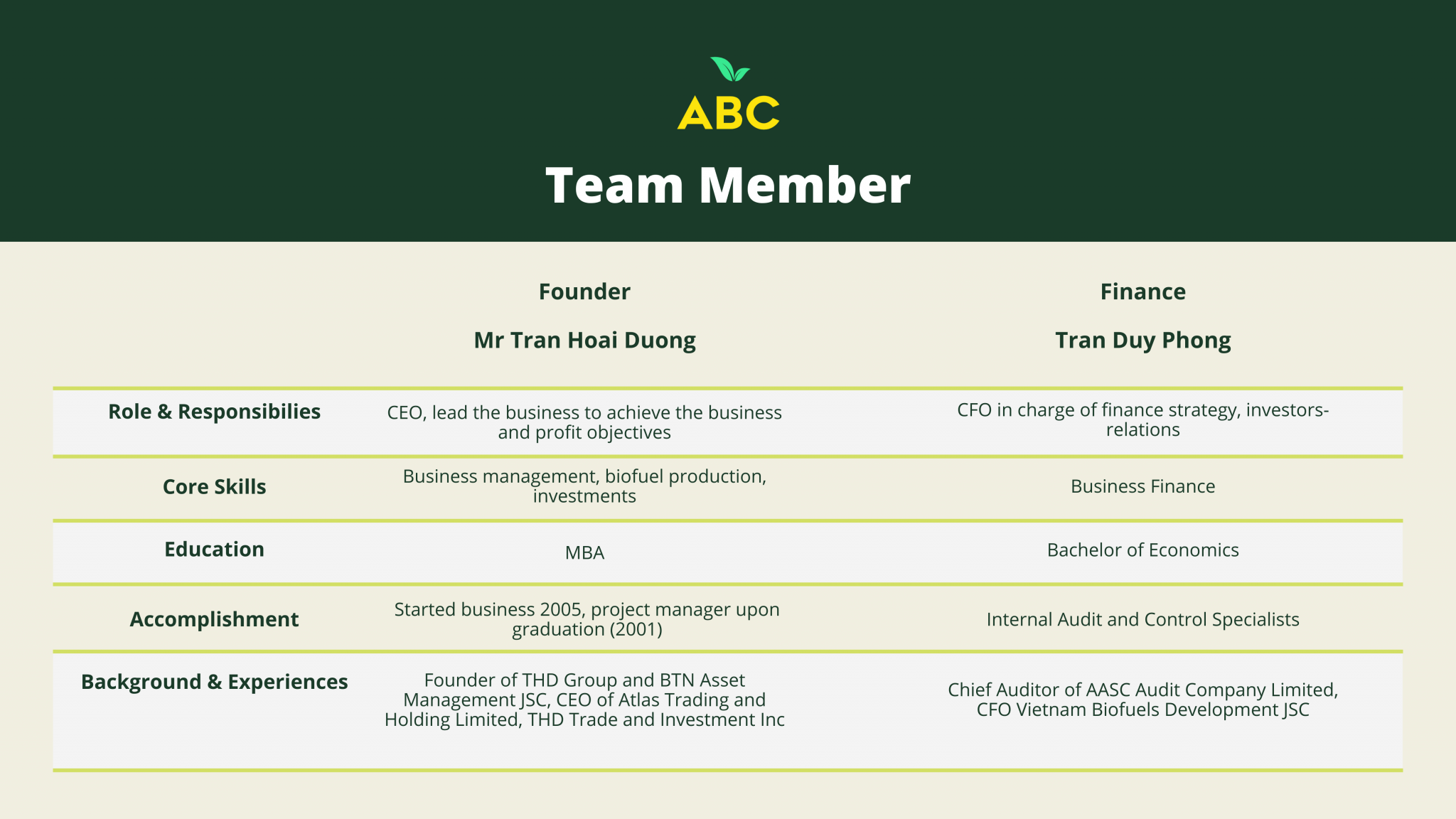

Asia Biofuel Corporation “ABC” was incorporated in Wyoming, United States, on March 5th, 2024, with 30% ownership held by ApexCapital.Asia Ltd and 70% by Mr. Tran Hoai Duong & Partners. Mr. Tran and his partners bring with them over 10 years of hands-on experience in managing and producing biofuels in Asia, particularly in Vietnam. They have overseen production and sales valued at US $93 million, yielding $3 million in profits despite working with limited and traditional facilities.

Raffles Capital Ltd “RC” (incorporated in Wyoming, United States) acting as venture-accelerator for promising firms that are ready and qualifying for a public listing on a North America bourse within 18-24 months of vesting. RC works with companies that can deliver social impact bringing prosperity and progress to the people and planet. These firms’ purpose must be in alignment with the UN 17 Sustainable Development Goals.

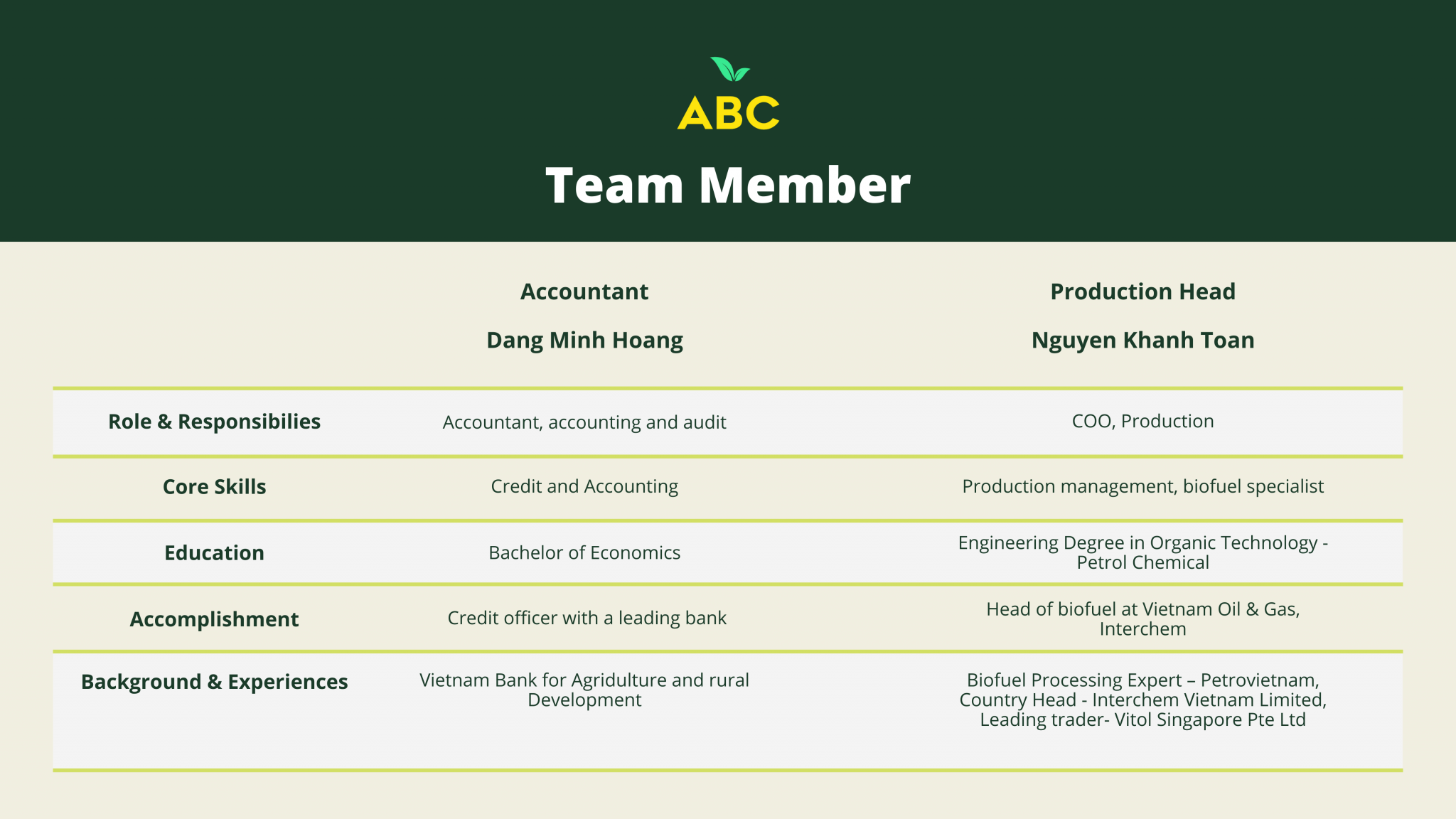

Apex Biofuel Pte Ltd “SA” is incorporated in Singapore as an Asia-based entity for central procurement, sales, banking, and investor relations. SA’s responsibilities include

- Appointing outsourced production contractors “OPC” in Vietnam, Indonesia, and the Philippines.

- Procures all feedstocks from the US, Brazil, India, Pakistan, and Eastern Europe, and consigns them to the OPC for production.

- Sells all production outputs to long-term clients in ASEAN.

- Handles all cash inflows, outflows, and submits all financial reports to ABC.

Strategy

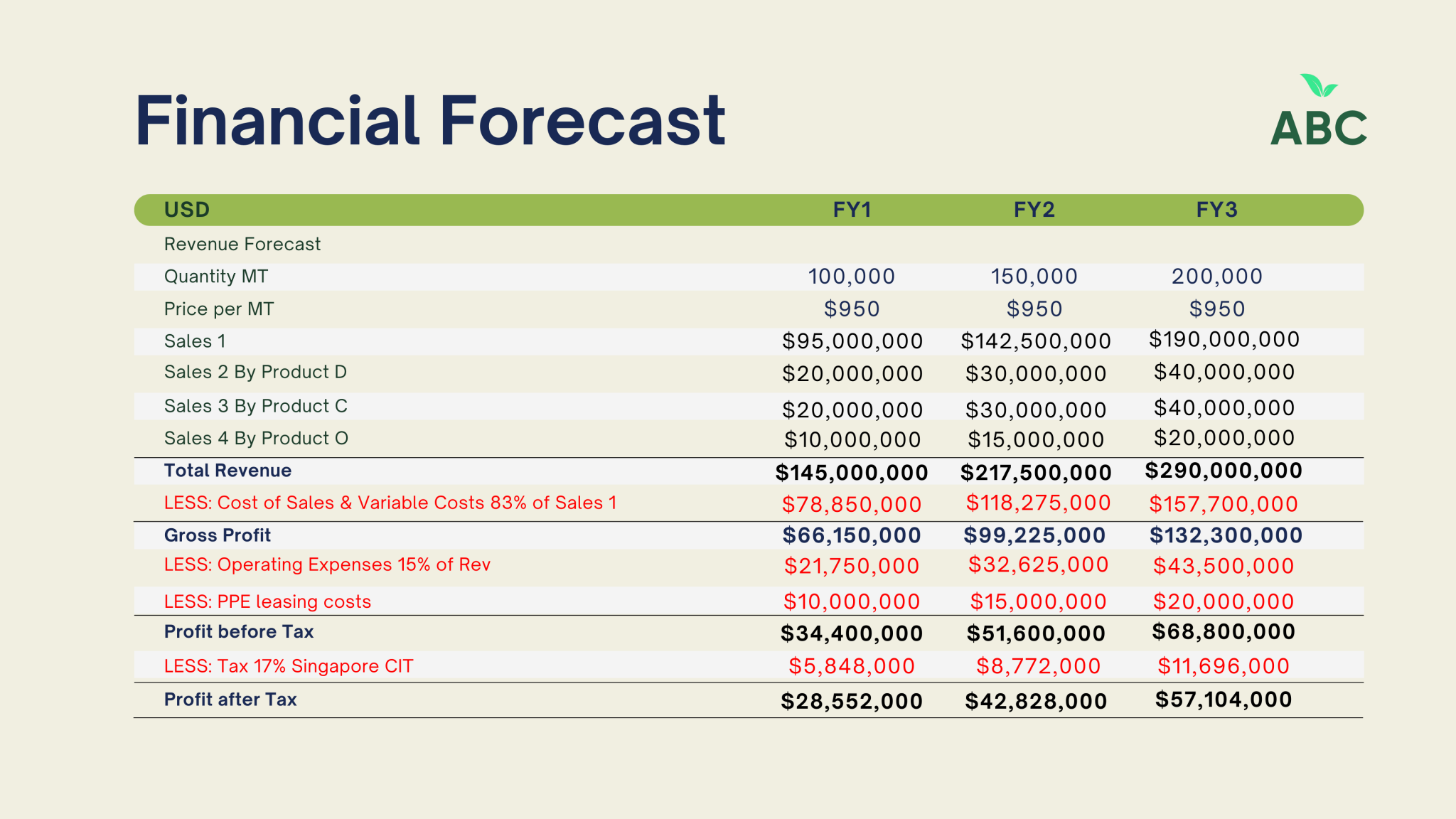

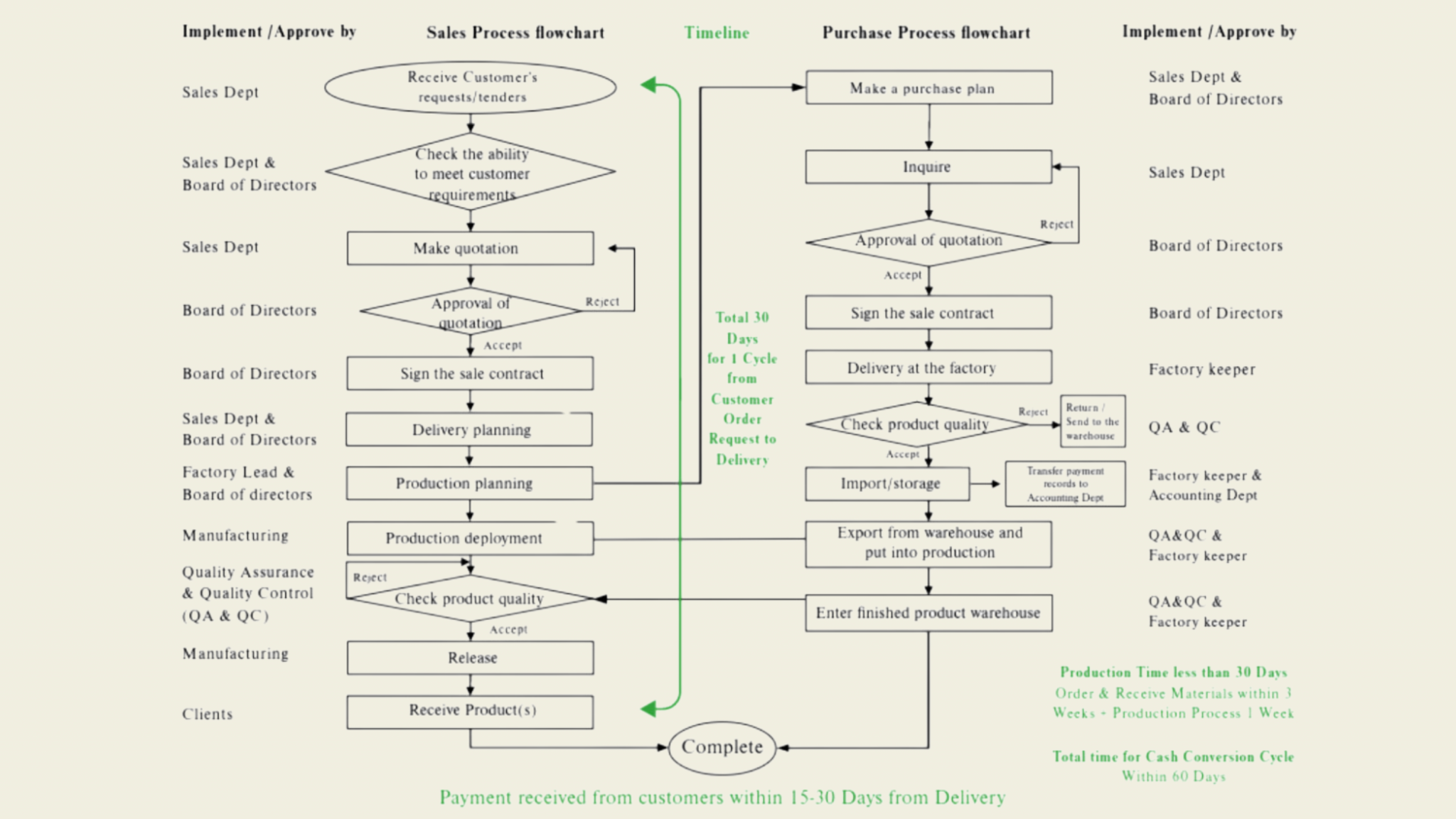

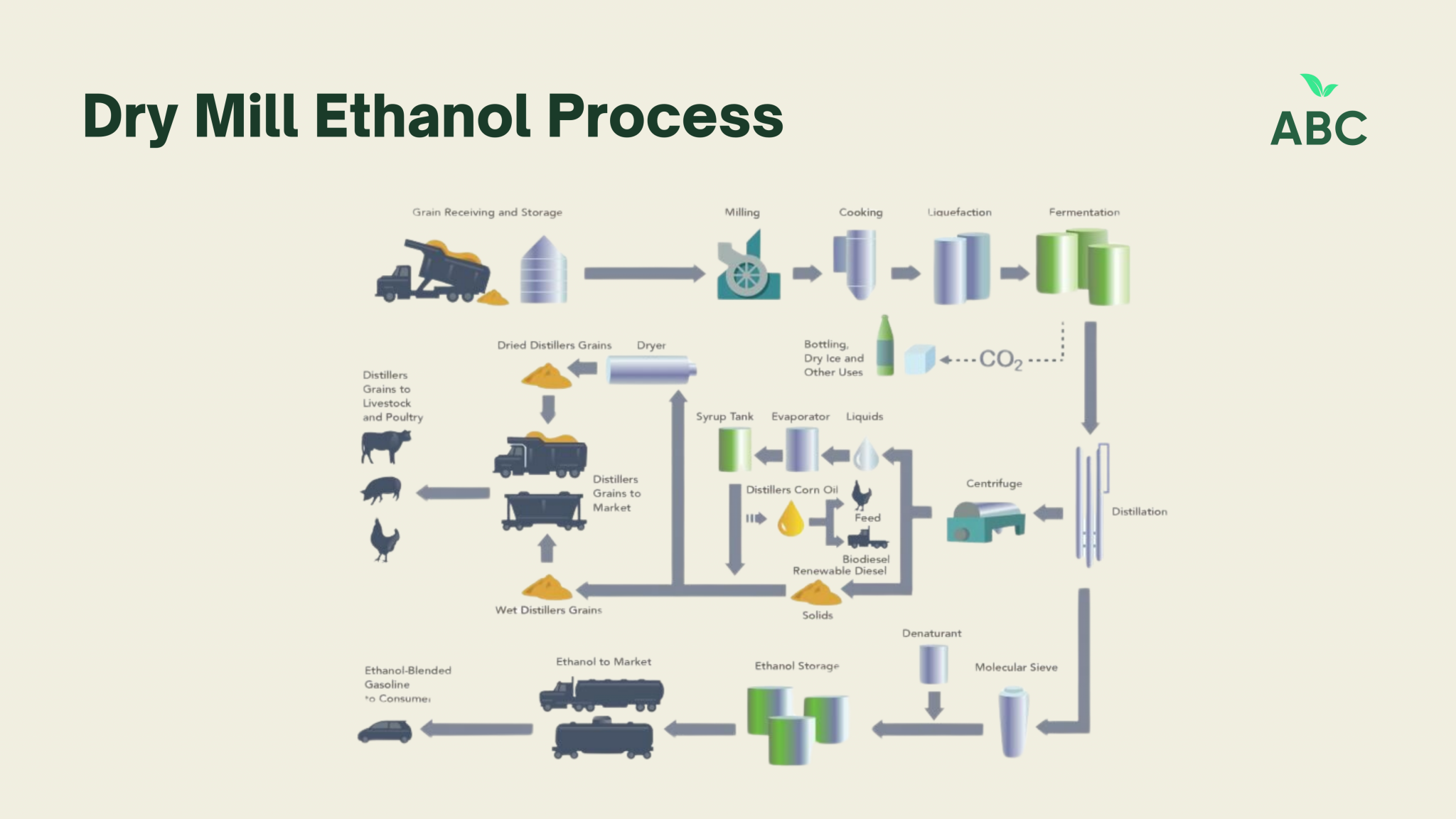

ABC is adopting an asset-light corporate strategy, wherein feedstock and raw materials are procured and consigned to the outsourced processing plant contractor, “OPC,” to produce end products for sale to ABC clients. The estimated working capital for procurement is $20 million.

ABC will specify and acquire up-to-date equipment for the OPC and assist in securing funding and bank loans for the purchase of property, plant, and equipment, “PPE,” by the OPC. The shortlisted OPC estimates the need for $40 million to upgrade and supplement new equipment into their current $40 million PPE.

ABC commits to a 10+10-year outsourced contract with the OPC to lease the plant and production services at 10% of the total PPE costs as a yearly fee payable quarterly in advance, at a rate of 2.5%.