Investment Summary

The CRE Diversified Income Fund

Opportunities in Real Estate

As real estate investors gain experience, they typically move away from single-family rentals towards more passive, less labor-intensive investments that can generate reliable streams of income.The specialized knowledge and capital requirements of commercial real estate mean that most commercial real estate investors partner with operating companies.

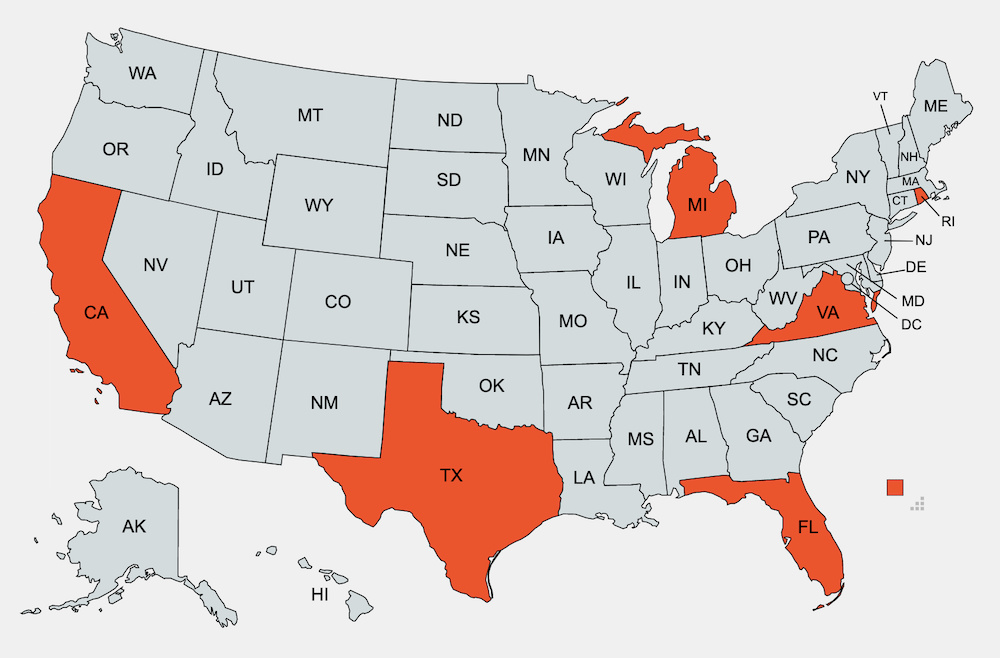

Our Diversification

Public Real Estate Provides Insufficient Diversification

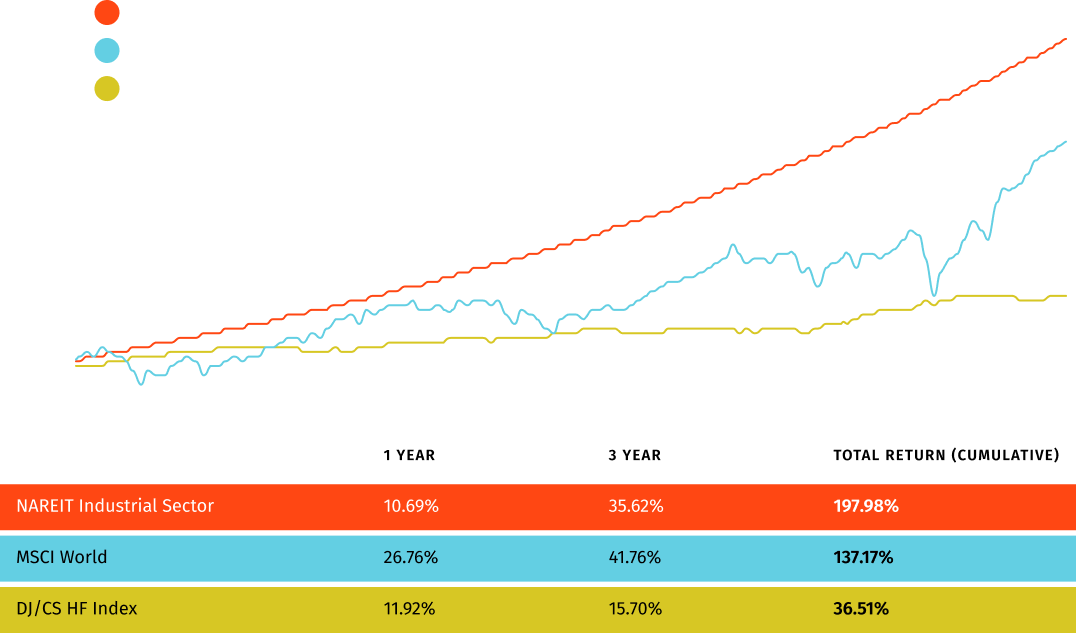

When many people think of real estate investment, they think of public Real Estate Investment Trusts (REITs). However, REITS are traded on the same exchanges as stock and bond securities and are subject to the same risks as traditional equity and fixed-income securities. REITs do not diversify away overall market risk, a major priority for experienced, high-wealth investors.Private real estate investments, on the other hand, are weakly correlated to the public markets, and thus provide better protection against capital loss as well as market volatility. Investing across multiple private real estate asset types and sectors (such as Industrial and Technology) provides additional diversification and risk protection.

Commercial real estate asset value is correlated to Net Operating Income. Unlike a single-family rental, a commercial real estate investment has an intrinsic correlation to its net operating income (NOI), which means an investor can make (or lose) money on the property regardless of what the broader market is doing.

Why Commercial Real Estate?

Tax EfficiencyCommercial real estate investments are structured in a tax-efficient manner allowing investors to reduce taxable income through the use of depreciation.

Flexibility

Real estate investors can be flexible in their investment strategy and timing, pursuing profitable deals where they’re available.

Why CRE Income Fund?

Key Benefits- A veteran team of commercial real estate professionals who understand changing market conditions and critical investment factors

- Deep experience identifying, selecting, acquiring and operating high-return investment properties

- Rigorous fundamentals research and analytics on technology and industrial real estate assets to find, enhance, and realize long-term portfolio benefits

- A focus on the private real estate sector for diversification and inflation hedging, mirroring how the wealthiest 1% invest

- A disciplined investment process framed by industry and population change seen through the lens of fair market value

- Predictable monthly income, stable returns, and mitigated default risk by leasing only to investment-grade tenants, with a defensive investment posture across a range of market conditions

How we work?

Tax EfficiencyBecause we are also invested in the properties, our incentives are aligned with yours. Our income and profit structure requires us to meet certain returns before our profit participation kicks in, ensuring our continual focus on profitability.

Clear Exit Plans

We enter an investment with the exit in mind giving investors a roadmap to a successful outcome.

Transparency

Fees and the profit participation structure are clear from the outset and closely correlated to the performance.