GoWorking™

GoWorking™Overview

The world has changed the way it works. The next normal for how, when, and where people work has now made a major shift to remote working. Many organizations are progressively moving toward a "hybrid" work anywhere model, meaning that a vast majority of employees will now be working partly from the main office, partly from home, and partly from a "third space."

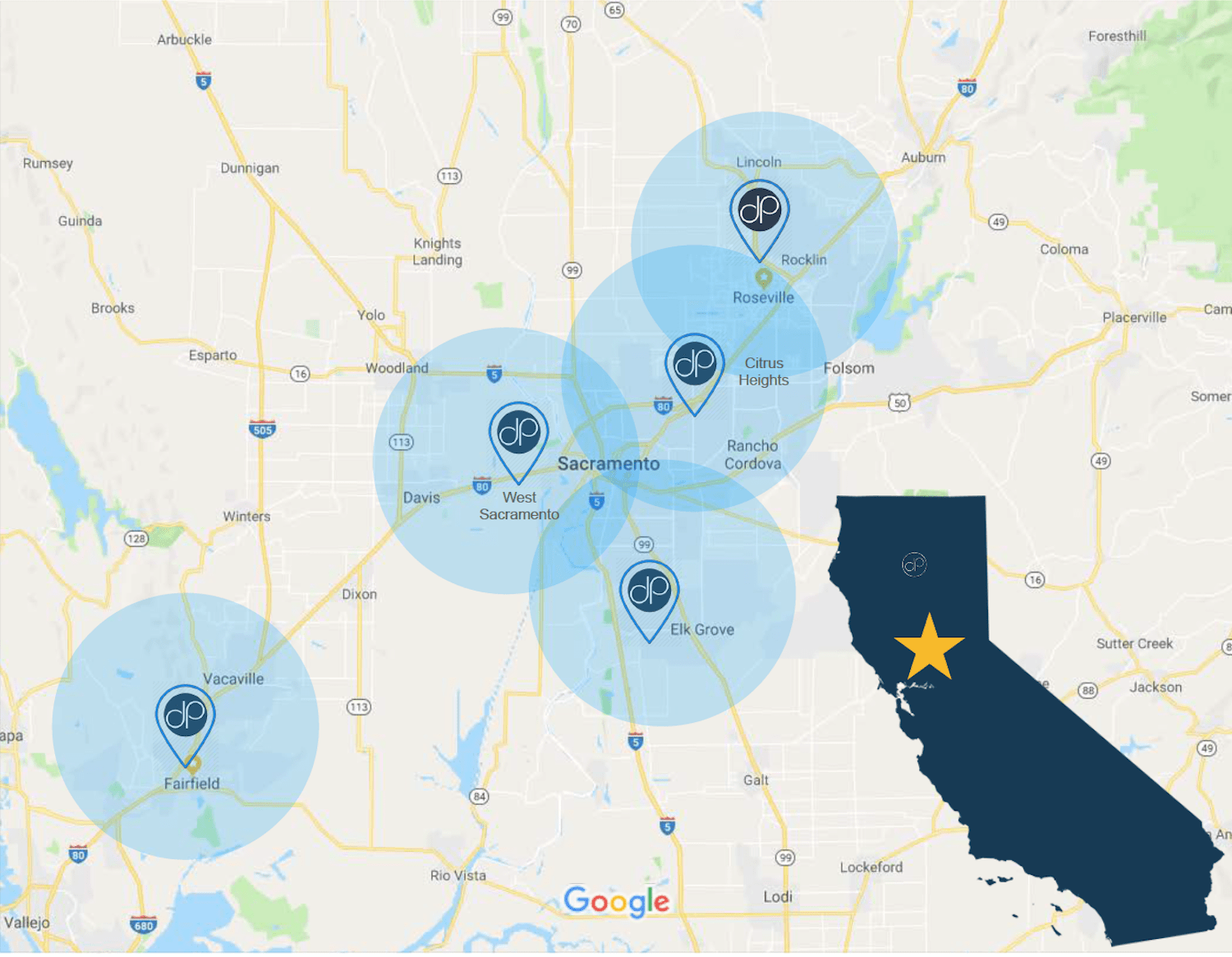

This is exactly why we designed and launched a network of dropin® goworking workspaces. dropin® is your third space between the home and office, conveniently located in your neighborhood in street-level retail centers, next to great coffee, food, and other lifestyle amenities so you can be productive and get your best work done.

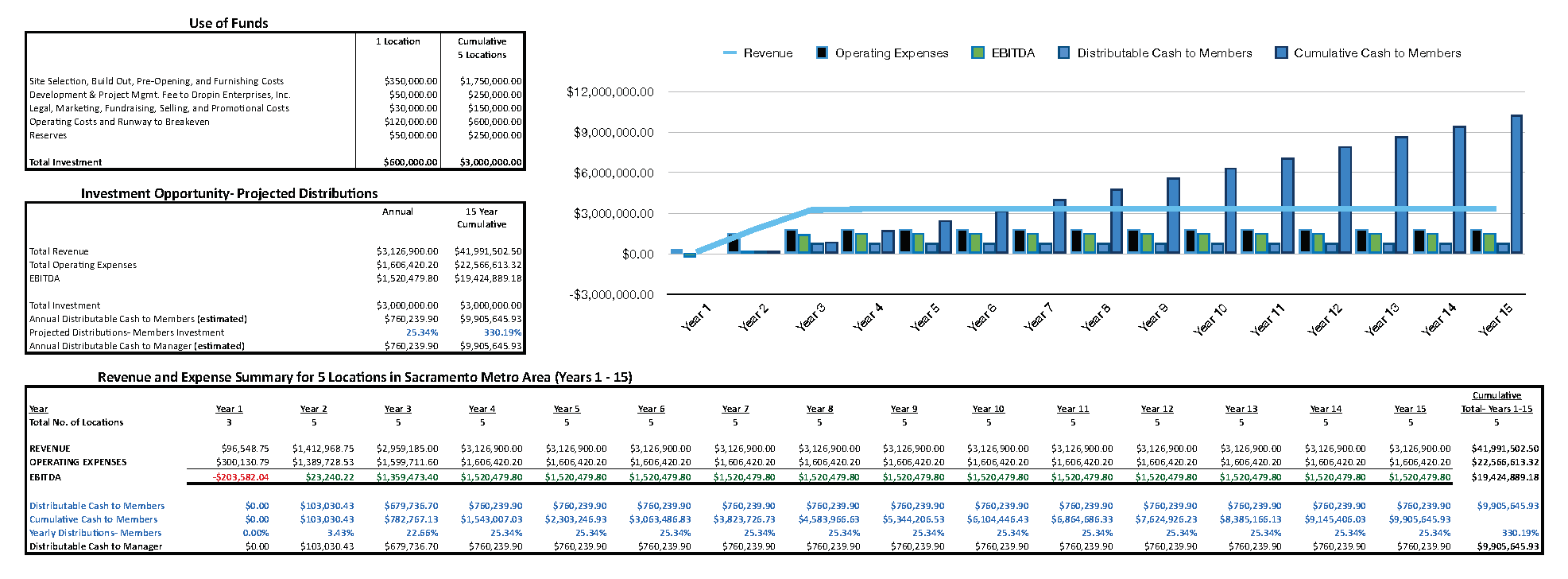

Would you like to be a part of our newest expansion to the Sacramento metropolitan area? If so, you can now own equity for a minimum investment of $5,000 and earn up to 25% IRR. Click the green "Invest Now" button to get started.

A global survey by Accenture found out that 79% of workers would like to work from a “third space.”

This is a location other than their home or office.

— Forbes, April 2021

This is a location other than their home or office.

— Forbes, April 2021

Remote Work Market

Below are just a few of the statistics which demonstrate and forecast this shift in the work environment:

- 70% of professionals work remote at least one day a week.

- 53% of professionals work remote at least half the week.

- There are 57 million freelancers in the U.S. representing 35% of the nation’s workforce.

- 50% of the working U.S. population will turn to freelance work over the next five years.

- This trend will continue and by the year 2028 there will be 90.1 million freelancers

"Remote Work is the driving force behind the coworking industry."

- A study by Cushman and Wakefield, estimates that coworking is growing at a rate of 10-15% annually.

COVID-19 Effect

Effects of COVID-19 on the Remote Work Industry:

"This crisis is going to shift work permanently."

— Mary Kay Henry, international president of the Service Employees International Union.

— Mary Kay Henry, international president of the Service Employees International Union.

"We’ll see much more remote work, we’re predicting by the end of 2021, it’ll be more like 30 percent of people (will work remote). "

— Kate Lister, president of Global Workplace Analytics

— Kate Lister, president of Global Workplace Analytics

"After a couple of months of lockdown and working at home, millions of people will be eager to work from somewhere else, anywhere else."

— Forbes Magazine

— Forbes Magazine