The equity investment offering to the value of $4,1 million is available, to be employed to acquire this real estate building called Two Forest Plaza Medical 26, located in Dallas, Texas, United States.

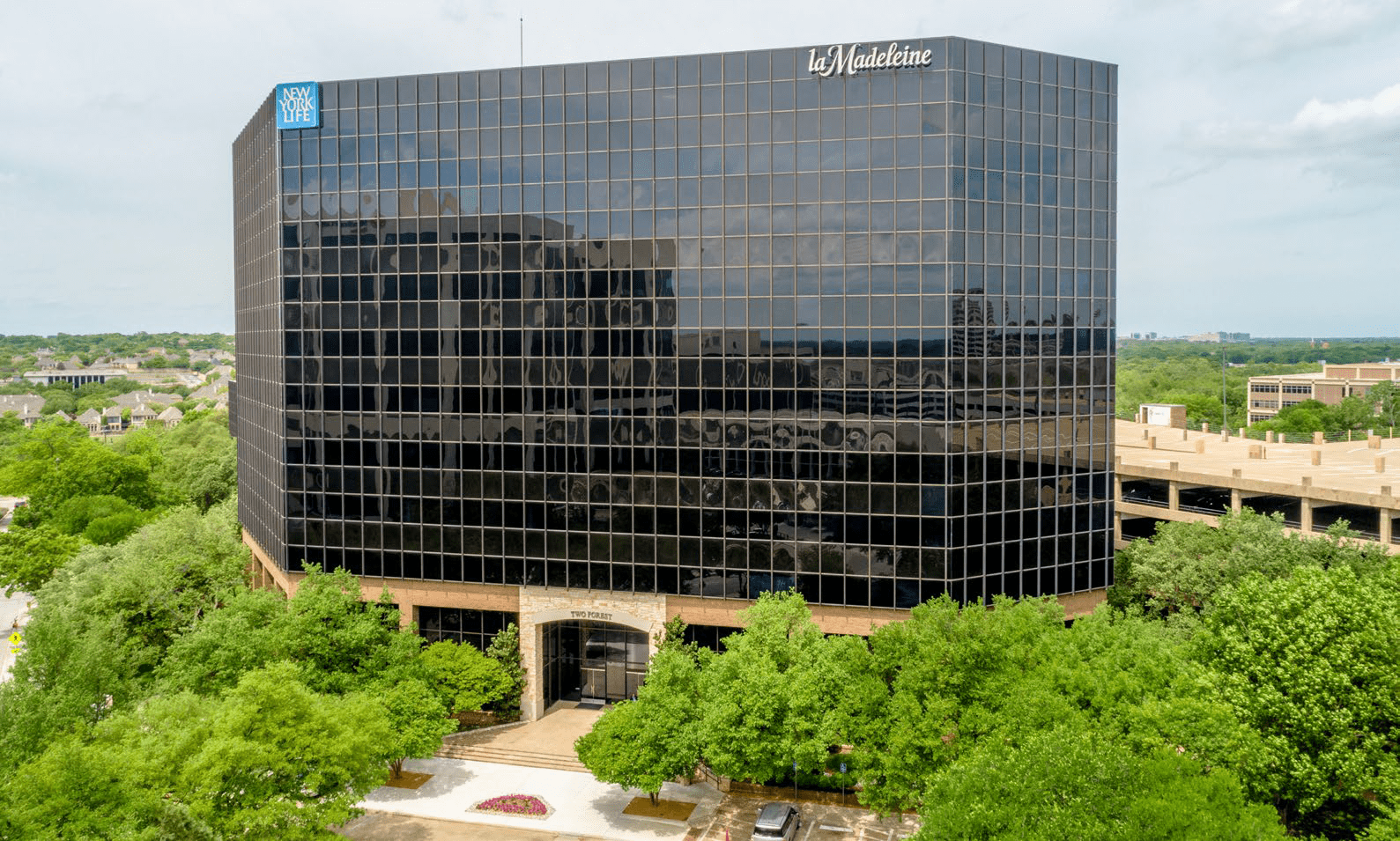

Two Forest Plaza was built on a 3,45 acre parcel with a 644 parking space garage in 1981 with renovations from 2014 to 2018. It is a 11-story office building that has 20% in place medical tenants. With a long-term credit tenancy with New York Life (a 38 year tenant occupying 42,276 SF through March 2022) and La Madeleine restaurants corporate headquarters (37,108 SF through October 2029) providing investment stability.

Located to nearby executive housing, prestigious country clubs, two major medical facilities such as Medical City and Presbyterian Hospital, twenty minutes to DFW airport via the LBJ and TEXpress managed toll lanes.Two Forest Plaza benefits from its strong location and accessibility to major thoroughfares.

A major hub for job growth and corporate relocations, the Dallas-Fort Worth area continues to expand during this economic cycle and the Infill Triangle remains a direct beneficiary. Recently completed nearby multi-family developments, retail and highway infrastructure allow Two Forest Plaza to perform at a level not experienced in almost 30 years.

Two Forest Plaza, with its efficient +/- 20,000 SF floor plates and diverse tenant roster, provide a Value-Add investment opportunity via immediate lease up of vacant suites with medical tenants and mark-to-market potential as leases expire, currently 15-20% below market.

Through the property partner’s medical tenant relationships, additional value will be unlocked by replacing the office tenants with medical tenants.

DALLAS METRO AREA

83.5% of the population of Dallas-Fort Worth-Arlington, TX has health coverage, with 51.6% on employee plans, 12.5% on Medicaid, 8.21% on Medicare, 10% on non-group plans, and 1.26% on military or VA plans.

The health care industry companies are located throughout the DFW region, where they can tap into a broad base of skilled employees. Dallas’ medical community includes the highly rated University of Texas Southwestern Medical center as well as Parkland Hospital’s burn unit, one of the most recognized units in the nation.

The health care industry in DFW is more than just services. It also encompasses manufacturing, research and goods distribution. The activities often cluster around each other, creating a synergy within the health-care community.

HEALTH CARE SYSTEMS IN DFW:

• 7 not-for-profit systems

• 2 National for-profit systems

• 28 Physician – owned and independent hospitals

• 1 Major Veterans hospital

• 4 National Headquarters in DFW

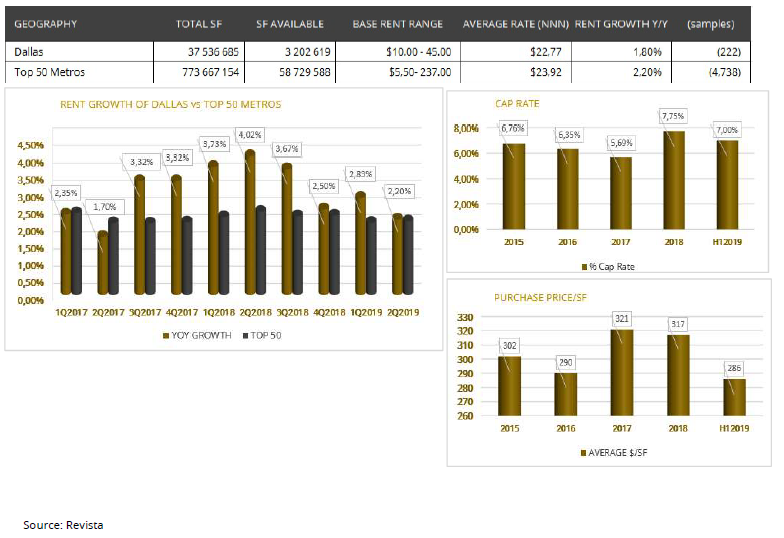

Medical Office Buildings Rent Analysis ending Q2-2019