DEVELOPMENT OPPORTUNITY

Sponsor is seeking $29,000,000 Senior Secured, Participating Loan facility to complete Phase I of the proposed development (the Loan).

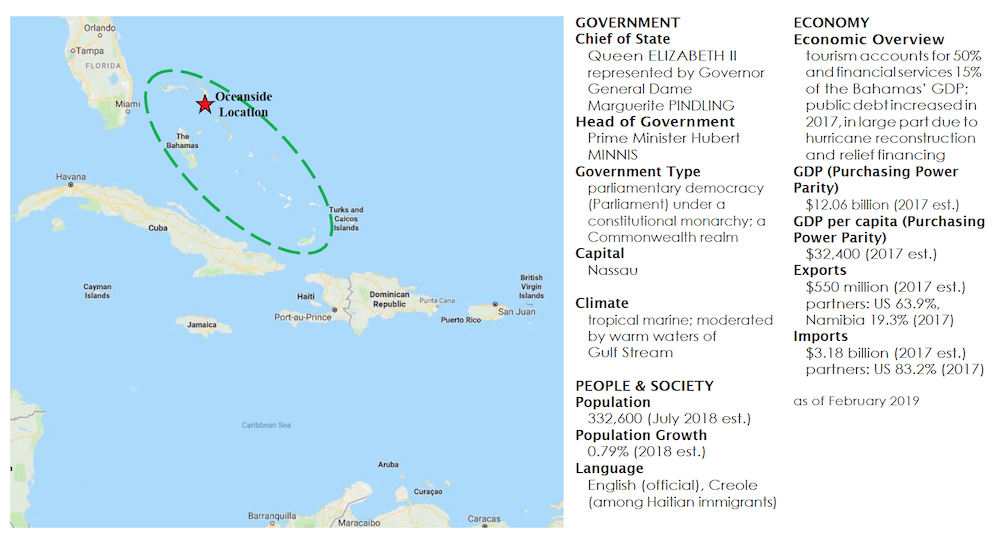

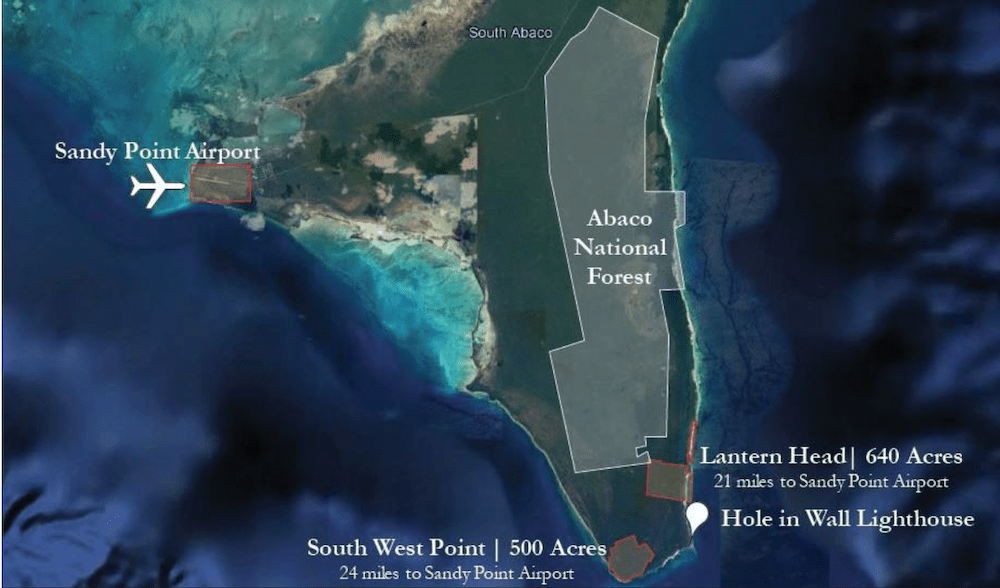

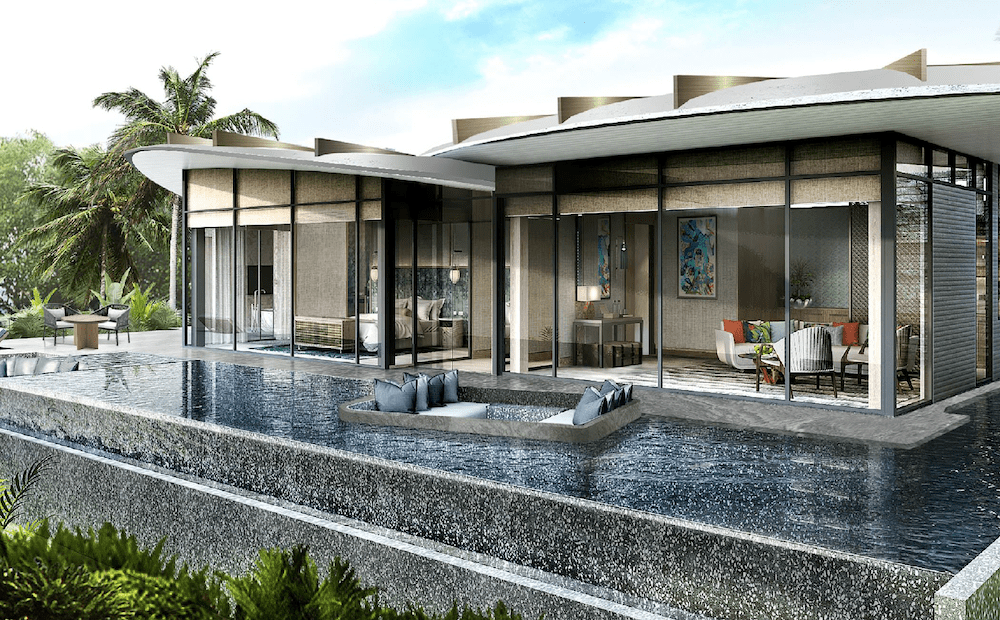

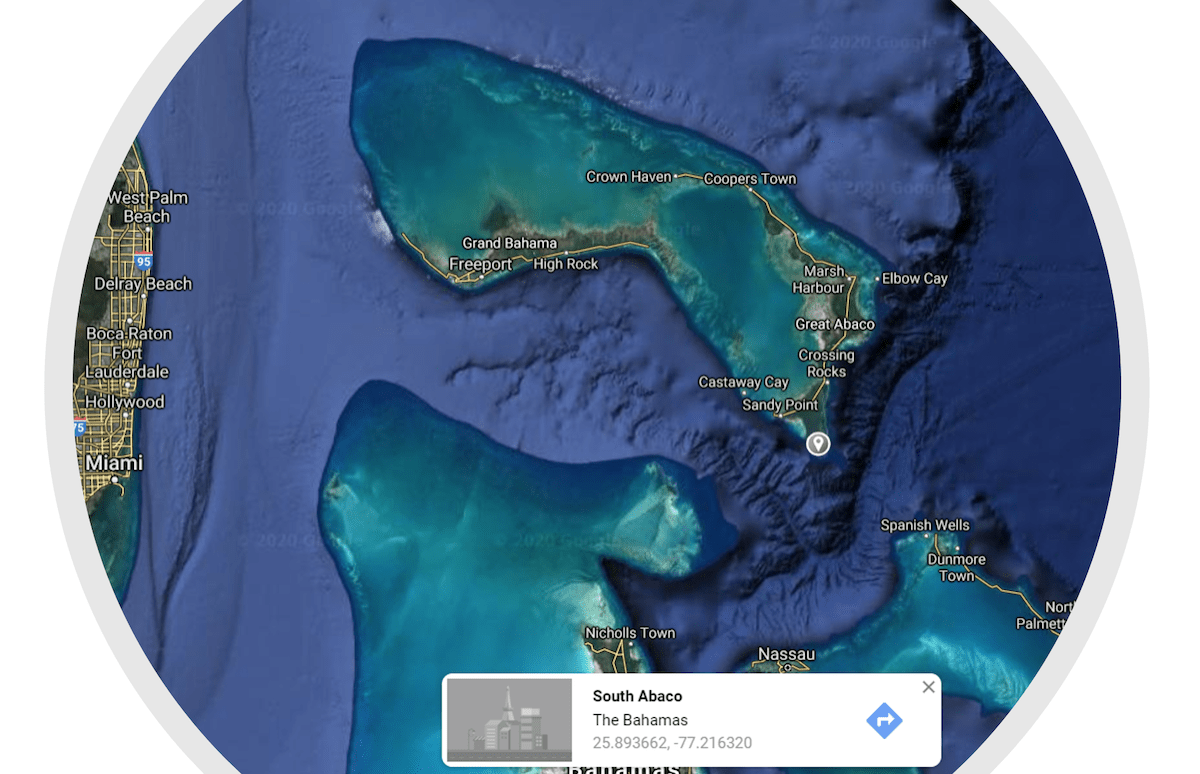

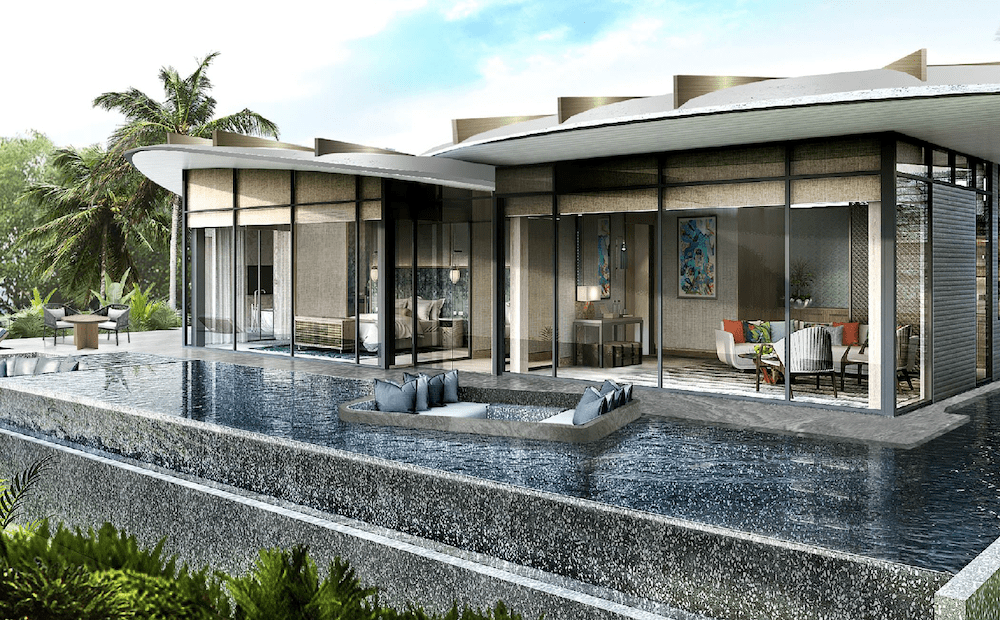

The development will be a best-in-class, ultra-luxury, low density (“social distancing” friendly), mixed resort developed on over 1,100 acres in the secluded and exclusive south of the island of Abaco in the Bahamas.

A January 2020 appraisal by CBRE has valued the land (the collateral for the Loan) on an as-is basis at $100,000,000.

At an IRR of ~20% the return on the Loan is high on a risk-adjusted basis.

The project has a signed development agreement with the government of the Bahamas and will commence as soon as the Loan is funded.

The development is endorsed by world renowned entities and will include amongst other things the first purposely designed and built superyacht marina in the North American basin.

Each minimum $1,000,000 investment unit in the Loan can be structured, if desired (and subject to some changes in the terms), to include, when the project is fully developed, a permanent residence in the Bahamas.

Investors in the Loan will be offered preferential participation in other elements of the development.

Sponsor is seeking $29,000,000 Senior Secured, Participating Loan facility to complete Phase I of the proposed development (the Loan).

The development will be a best-in-class, ultra-luxury, low density (“social distancing” friendly), mixed resort developed on over 1,100 acres in the secluded and exclusive south of the island of Abaco in the Bahamas.

A January 2020 appraisal by CBRE has valued the land (the collateral for the Loan) on an as-is basis at $100,000,000.

At an IRR of ~20% the return on the Loan is high on a risk-adjusted basis.

The project has a signed development agreement with the government of the Bahamas and will commence as soon as the Loan is funded.

The development is endorsed by world renowned entities and will include amongst other things the first purposely designed and built superyacht marina in the North American basin.

Each minimum $1,000,000 investment unit in the Loan can be structured, if desired (and subject to some changes in the terms), to include, when the project is fully developed, a permanent residence in the Bahamas.

Investors in the Loan will be offered preferential participation in other elements of the development.