GREAT LOCATION:

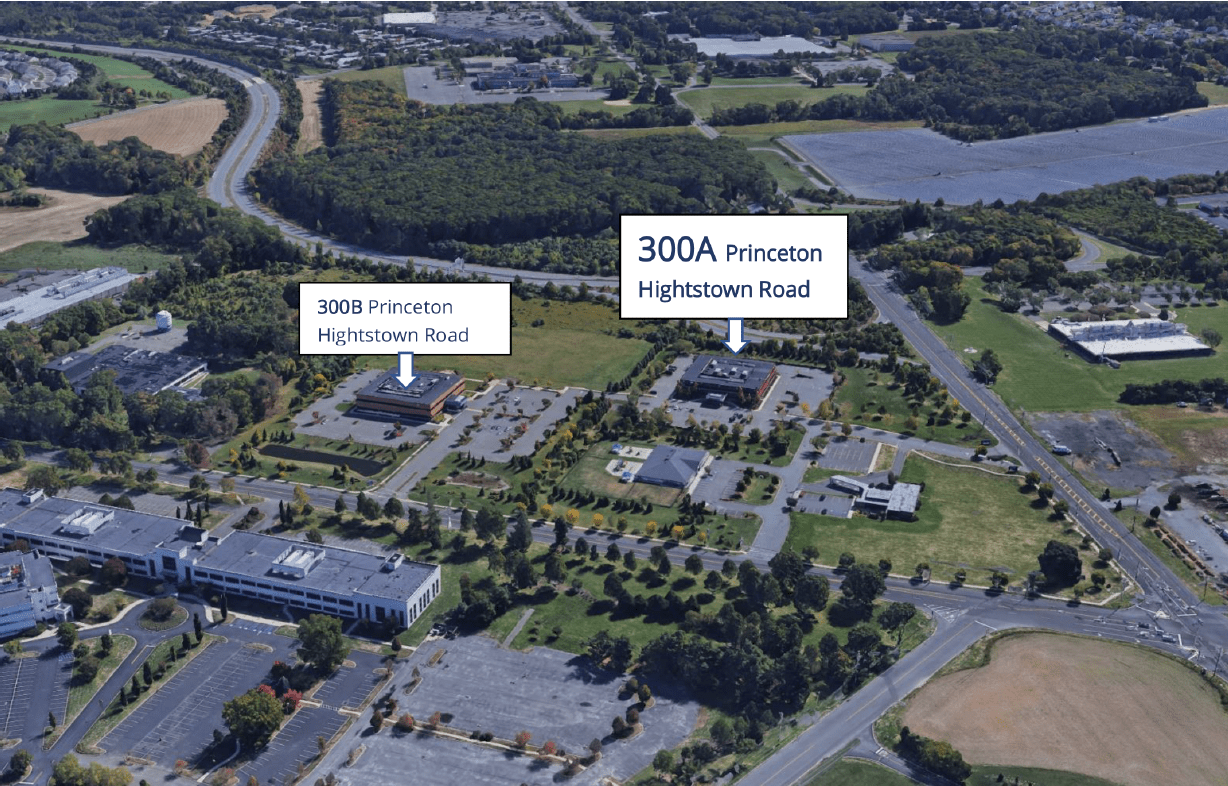

The property is served by New Jersey Turnpike’s Interchange 8, located equidistant between New York City and Philadelphia in East Windsor, New Jersey.

MEDICAL OFFICE BUILDING::

40,611 square feet of Class A property was completed in 2006.

RETURNS:

Forecasted quarterly dividend of 8.3% - 9% annualised with targeted IRR of 11.20% nett for investors.

COST:

- $11,2 million in total of which $9,8 million is the building acquisition cost

- $0,53 million is transaction fees and

- $0,55 million is tenant installation and leasing commission reserve

FUNDING:

- $4,35 million equity raise includes 5% equity from the sponsor

- $6,8 million bank loan

HOL,DING PERIOD:

The investment period is planned for 5 years.

An equity portion of $4.1 million is now available to investors, which will be employed to acquire this Medical Office Building. The investment is available to investors from as little as $5,000.

The area has an affluent population which supports the private health care sector providing consistent and growing income for the medical practitioners. Princeton 300A was built on a 5,98-acre parcel of land in 2006.

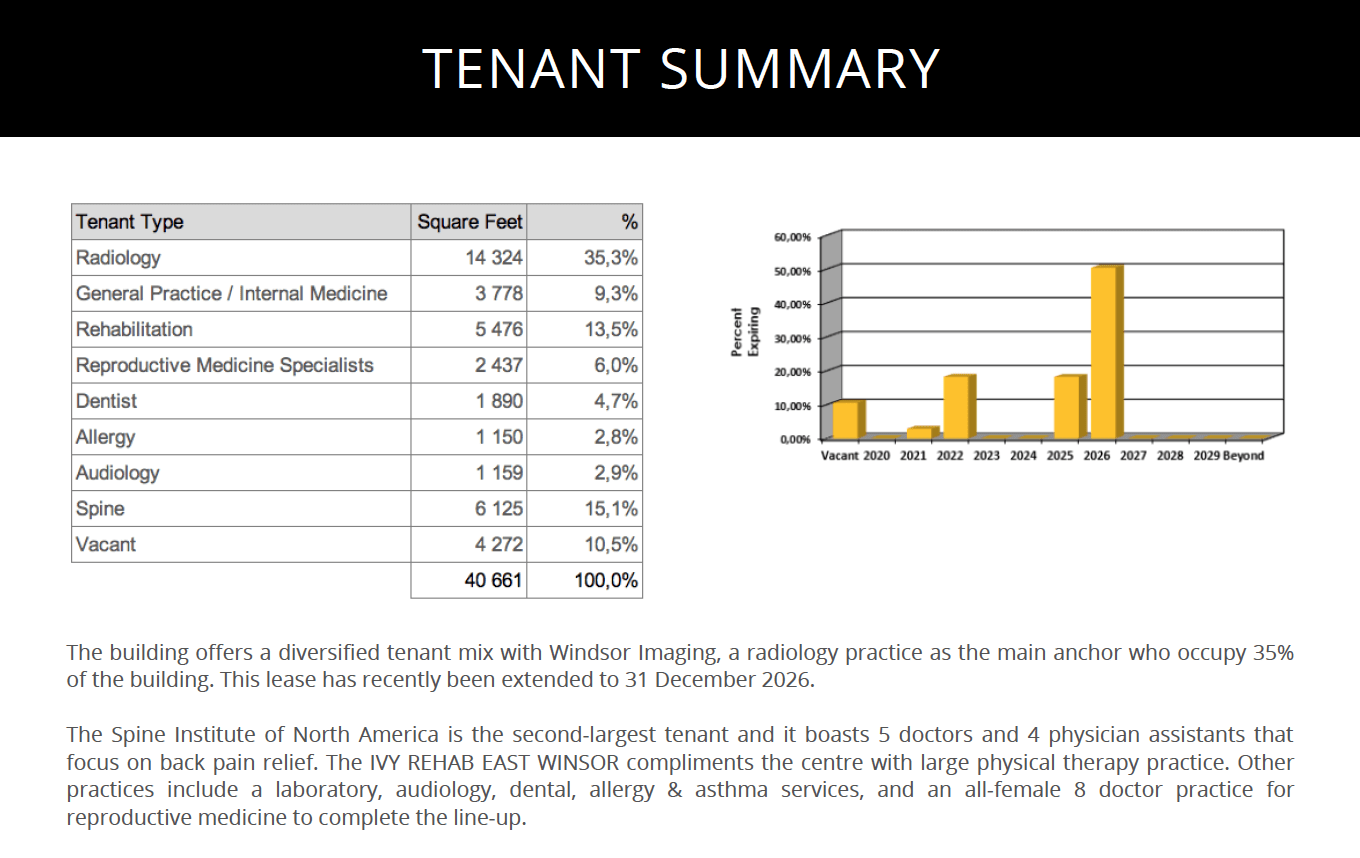

It is a 2-story building and 89.5% of the existing tenants are medical tenants. The building is anchored by Windsor Imaging, a highly successful radiology practice, who have been part of the New Jersey medical community since 2006.

Windsor Imaging has recently renewed its lease for an additional 5 years, ending in 2026. The Spine Institute of North America is the second- largest tenant which boasts 5 doctors and 4 physician assistants who specialise in back pain relief.

We have identified the resilience of rehabilitation hospitals and physical therapy facilities, and this building is also home to The Ivy Rehab East Winsor physical therapy practice.

The Institute for Reproductive Medicine and Science is an allfemale 8 doctor practice specialising in reproductive medicine and is also an important drawcard attracting patients from all over the state. Other services offered in the building include a laboratory, a dental practice as well as specialist audiology, allergy & asthma practices.

This prime building provides investors with an inflation protected NNN investment limiting landlord responsibilities, and the staggered lease expiration’s mitigate rent roll over risk. These established specialty practices, with their historical lease renewals, the quality of the construction and condition of the structure, combined with East Windsor’s central location, all underscore the investment’s stability.

The property partner, Whyte Capital will invest 5% as part of the total equity requirement for this investment.

This investment opportunity provides a stable income from the in-place leases capital preservation over the 5-year planned investment period.

NEW YORK - NEWARK - JERSEY CITY METRO AREA:

The quality of healthcare in New Jersey continues to improve. In a recent report by the Leapfrog Group, the State moved to the top of the list from its previous ranking of 17, for the number of hospitals with class A safety ratings.

New Jersey’s aging population continues to drive the growth of medical care needs. Nearly 15% of residents in the Garden State were age 65 or older as of 2015. By 2030, that figure will approach 20%.

Hackensack Meridian Health has responded to the needs of the market and its planned $714 million Hackensack University Medical Centre expansion, is possibly the biggest hospital expansion in the history of the state. Healthcare costs also continue to grow, spurring more patients to choose less costly outpatient facilities.

The aging population was a major contributor to the U.S. healthcare job growth. The sector outpaced nearly every other industry, adding more than 14% of all new jobs nationally. The health care industry continues its streak of job growth in New Jersey increasing its share of private sector jobs within the State to 16.6% over the past year.

Within the sector, home health services continue to increase, and related job opportunities are expected be the among the fastest for the foreseeable future.

The medical office market is seeing good growth in rental rates, given the lack of additional new supply, compared with the real estate market as whole. The vacancy rate improved to its lowest level since mid-2009 to 4.57%.