Xago Technologies

Innovative money movement.

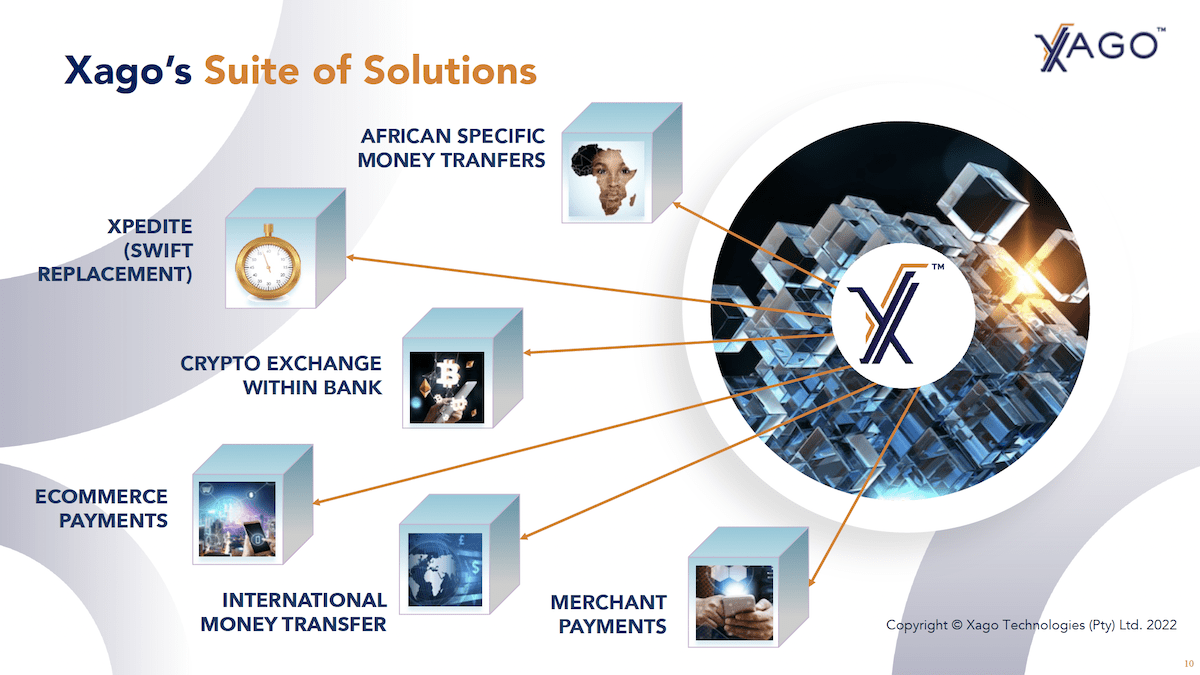

Xago enables innovative money movement through the use of crypto transactions (rails). Currently, the movement of funds across borders is expensive, slow and fraught with challenges, for both consumers and businesses, for small or larger values.

Today, when a consumer moves money across the border in small values, it is not unusual for them to be charged 10% of the initial funds. The transaction may take 5-10 days and often much longer, and without any certainty when the destination will or has received the funds.

For the bank to move $10,000, it can cost businesses or individuals 3% of the initial amount and take 2-5 days, and again there’s no certainty when or if the funds have been received.

With Xago, we can address these 3 key areas for both consumers and businesses. Xago can now move money domestically within 3.8 seconds at a fraction of the cost.

Move money for a consumer across the border, for example from South Africa to the UK, in less than 5 minutes at 0.50%, and with confirmation the destination has received the funds. For businesses the speed, cost and certainty is repeated as we utilise exactly the same platform.

Our view is that in just a few years, the use of the word ‘crypto’ in payments will be part of the past narrative, because if you make a movement across the border at a bank today, the consumer usually does not know that the bank uses the SWIFT service – unless they are keen to understand.

Xago moves FIAT to FIAT, quickly, with reduced costs with certainty using the power of crypto!

Global Money Transfer Challenges

Current international money transfer processes are often slow and costly for both B2B and B2C banking clients:

- taking 2-5 days for money to move from sender to recipient

- fees from all the parties can cost over 9%, especially evident in Africa

- uncertainty in transaction finality

According to the World Bank in excess of $600Bn is sent via personal remittances in 2021 and over $25Tn in the Exports of Goods and Services.

SWIFT reports processing 20M+ daily messages, with EMEA (Europe, Middle-East, Africa) accounting for 45.1% of the payment transactions.

In Africa with 38% coming from North America, 28% from Europe, Others 19% and Africa accounting for 15%.

South Africa has accounted for over $500m in 2022 alone, with average of over 14% in fees (Source: Remitscope.org)

Who is Ripple

Ripple is a crypto solutions company that transforms how the world moves, manages and tokenizes value. Ripple’s business solutions are faster, more transparent, and more cost effective - solving inefficiencies that have long defined the status quo. And together with partners and the larger developer community, we identify use cases where crypto technology will inspire new business models and create opportunity for more people.

With every solution, we’re realizing a more sustainable global economy and planet - increasing access to inclusive and scalable financial systems while leveraging carbon neutral blockchain technology and a green digital asset, XRP.

This is how we deliver on our mission to build crypto solutions for a world without economic borders.

Why Ripple:

- Relationships with large banks across the world

- Products for large transaction sizes

- Support in 50+ Countries

- Strong on Regulation

- Focus on Cross-Border Payments

- Big Investor Network

- Relationships with Central Banks