INTRODUCTION

Welcome to Own Gold, your gateway to the lucrative world of gold. As an internationally recognised gold provider, we specialise in direct transactions with mines, connecting the global market through our trusted network of refineries.Own Gold was established with a clear vision; to provide a diverse array of top-tier investment opportunities within the global gold sector. At the core of our mission lies a profound understanding of the inherent power of gold. Our founders take pride in curating a wide spectrum of investment avenues, ranging from loan notes, tangible bullion, and gold coins to strategic investments in international mines. Moreover, we assist Ultra-High-Net-Worth investors in harnessing substantial profits through gold trading.

Irrespective of your investment preferences, Own Gold is meticulously designed to optimise your returns in the most secure and efficient manner possible. One of the pivotal motivations behind the inception of Own Gold stems from gold's unparalleled ability to safeguard portfolios and uphold one's standard of living. In the current climate of global uncertainty, gold remains a defensive asset, consistently yielding profits amid persistently challenging investment landscapes.

Whether you're a seasoned investor well-versed in commodities or taking your initial steps into this realm, our expert team stands ready to navigate this journey alongside you. We specialise in tailoring investment strategies that align precisely with your unique aspirations and financial objectives.

Recognising the paramount importance of wellinformed decisions, we offer complete transparency and continuously updated information. Our goal is to empower you to craft a robust investment portfolio centered around the world of gold.

“Gold is money, everything else is credit”

OUR PURPOSE

One of the reasons why Own Gold was created, is because its Founders are fully aware of the power that gold holds. One of gold’s strongest advantages is that it can protect your investments, (even your standard of living) during periods of economic, monetary, or geopolitical crisis. Depending on the nature of the crisis, gold can move from a defensive tool to an offensive profit machine.

Gold is the one of the most secure stores of wealth on the planet and its consistent growth has drawn substantial investment. Artisanal and Small-Scale Mining (ASM) accounts for over 20% of annual gold production worldwide and it is within this segment that much of the recent growth has occurred.

Gold has always been in high demand as an investment and a status symbol, maintaining a strong place in investors' portfolios—now more than at any point since the 1970s

In a recent report by Forbes relating to the potential of gold in 2023, many analysts predict that gold is going to experience a sharp rise in value.

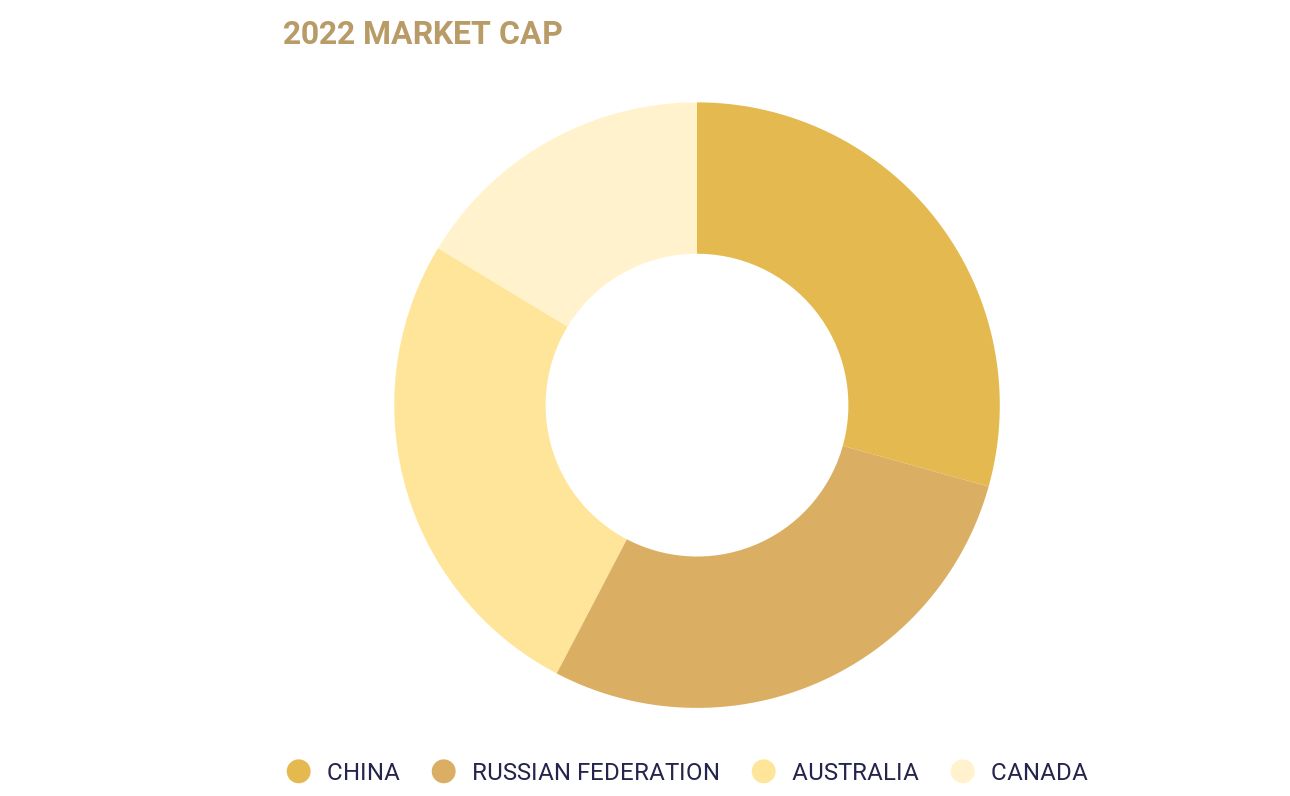

The graph to the left represents the total amount of gold purchased by Country in 2022. At the time of writing, gold has seen a peak of $2,039.05 per ounce, and a low of $1,648.67 per ounce.

“The Royal Mint has seen the demand for precious metals and gold jump by 200% as young investors also turn to gold as an alternative to other assets”,Andrew Dickey, Royal Mint.

Own Gold is a UK based gold provider that has created a unique turn-key investment opportunity for those looking to build wealth by investing in gold.

SECURE GOLD WITH A

BELOW MARKET

DISCOUNT

Founded in 2022, the company has spent the last year developing key relationships across Africa, UAE, South America, Australia and the surrounding Pacific Islands. Areas which are rich in natural resources and home to some of the world’s largest gold mines.

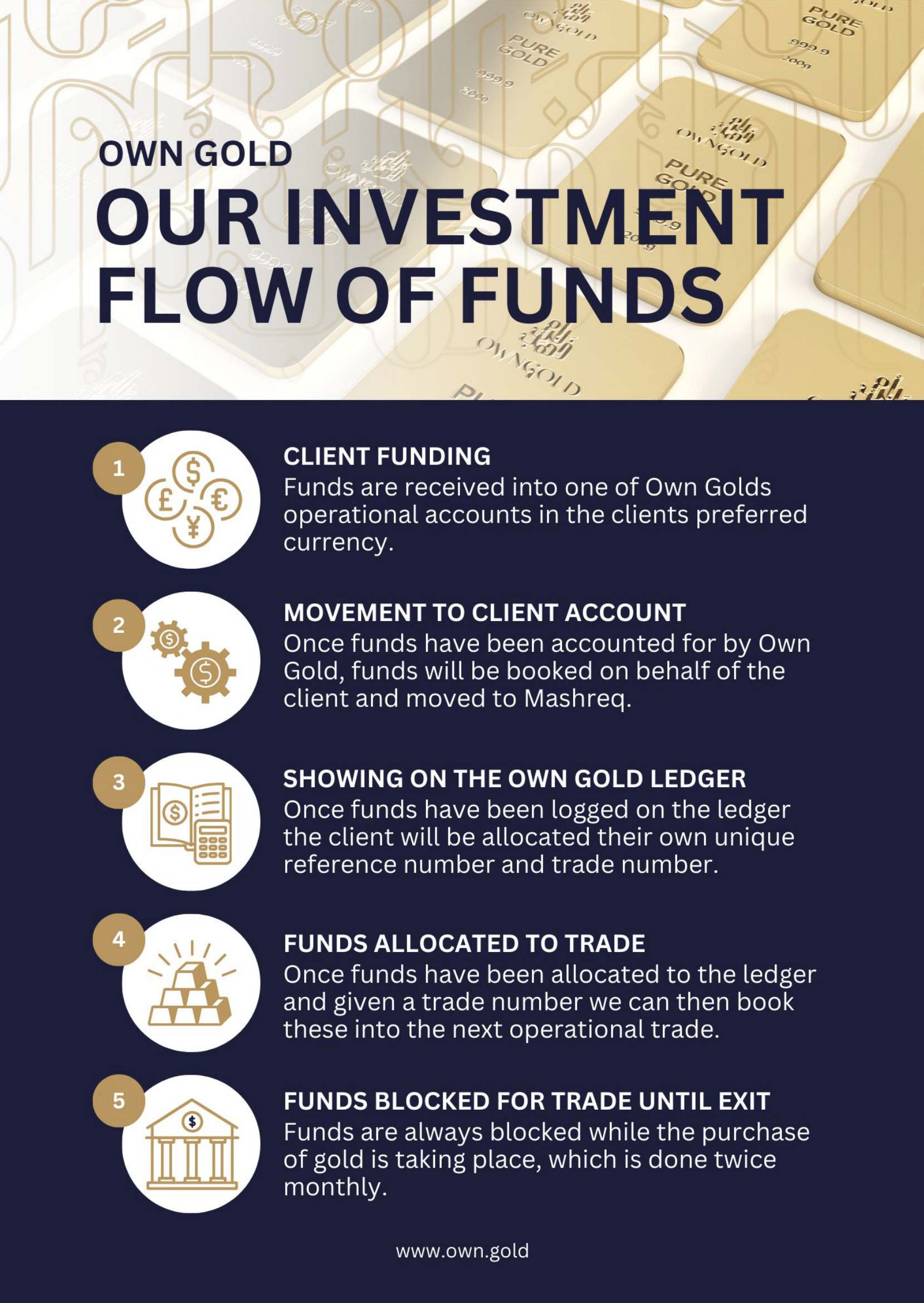

OUR PROCESS

- Locate active supply chains and lock in for a minimum term of 12 months via an SPA.

- Secure transportation via Transguard / Brinks or Emirates Sky Cargo to our global refinery network.

- Upon delivery the assay is conducted to verify the purity before funds are released.

- Once refined the Pure Bullion will be hallmarked for delivery to our end buyers.

Once the gold is mined, it is then shipped to one of our preferred refineries based in the UK, UAE, Switzerland or Australia, depending on the location of the gold. Our partners in these refineries have also agreed the purchase of the gold upon refining at a discount of up to -1% below spot per tranche.