Welcome to Raffles Capital

Our company acts as a venture accelerator for promising firms that are ready and qualify for a public listing on a North American exchange within 18-24 months of vesting.

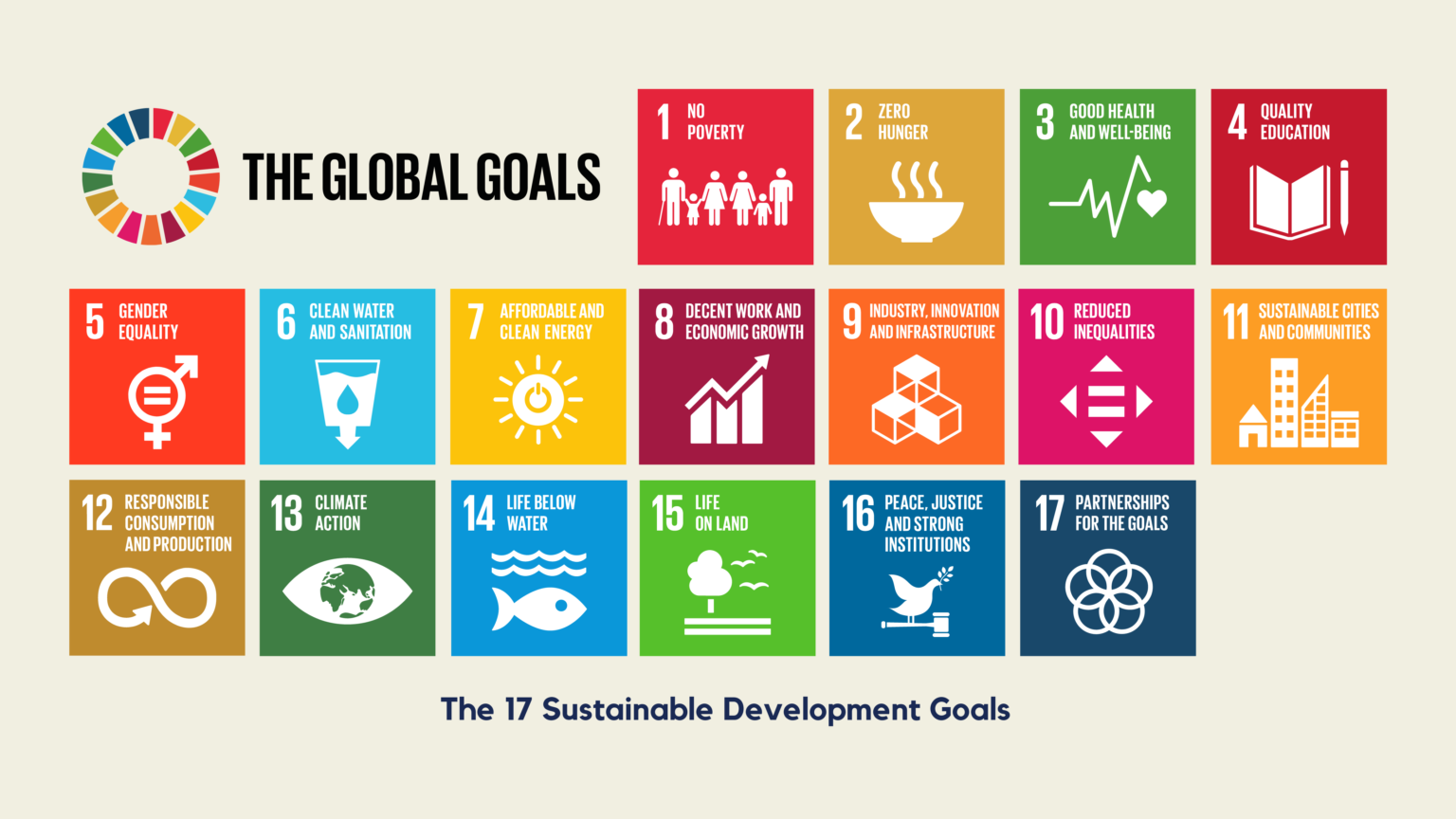

RC works with companies that deliver social impact, fostering prosperity and progress for people and the planet. These firms' purposes must align with the UN's 17 Sustainable Development Goals.

Why Choose Us

Average 30+ Years

of Corporate Finance and Business Experience

Reputable Business

Strong supporting associates in USA, Australia, Canada, China, Singapore, Hong Kong & SE Asia.

Extensive Connections

To Talents, Technologies, Territories and Tranches of funding to accelerate a firm's growth & expansion

Background

These firms’ purpose must be in alignment with the United Nation's 17 Sustainable Development Goals.

Our Journey

Raffles Capital was founded in Australia on 22 May 2000 with investments in residential and industrial real estates and equities of mining companies in Australia & New Zealand.

Abigail Zhang invested in the company in December 2014 and with Dr Charlie In on board as Chairman, they engineered a spin-off of all the real estate and mining investments and became an investment and advisory company – a diversified financial services company.

Raffles Capital was involved with several investment and advisory deals in Australia and China that covered property, solar energy REIT, agriculture, coal, copper, gold mining and healthcare services.

In 2016, Abigail and Charlie incorporated Raffles Capital Pte Ltd to home the business in Singapore and to privatise the ASX-listed company which was approved in March 2019.

Both founders of Raffles Capital Pte Ltd decided to form a financial services firm, Raffles Financial, to provide corporate finance advisory and IPO arrangement services for firms seeking public listing in Australia, Europe, North America, Hong Kong and Singapore. In July 2018, Raffles Financial Pte Ltd started business as an exempt corporate finance advisor registered with the Monetary Authority of Singapore. The company was listed on the Canadian Securities Exchange in May 2020 with a market capitalization of C$250 million, delivered net profit of S$12 million in 2021. By December 2020, the company’s market cap went up to C$500 million. Then Corvid-19 disrupted the business and all had to hibernate.

In 2021, Raffles Capital and the founders invested in Raffles E-Money International (REMI), a merchant and membership loyalty program manager that provides merchants & members with offshore bank accounts, global debit cards, crypto-currency wallets, loyalty points and tokenized trade financing. Members and Merchants can make use of the global payment system to pay for their transactions in cryptos, loyalty points and fiat currencies across 40 million outlets worldwide.

In anticipation of the regulatory changes in Hong Kong, founders of Raffles Capital have holdings in Victoria Financial Group to serve China, Hong Kong, Macau, Taiwan companies with advisory in share transactions, fund management, key-man and liabilities insurance. Victoria Financial is licensed by SFC for approvals in type 4, 9 and insurance services.

Raffles Capital together with the founders are significant shareholders of several public-listed companies that are in the food and beverage business, grocery and food distribution, digital infrastructure, durian & fruits exports and lab-grown diamonds for microchips.

In October 2022, both Abigail and Charlie transferred their shareholding rights in Raffles Financial Group to Raffles Capital Pte Ltd and thus became the majority shareholder of Apex Financial Group Limited based in the United States of America. Apex’s main subsidiary operates www.ApexCapital.Asia, an online corporate finance and fundraising advisory firm helping US companies that are addressing the Indo-Pacific fast-growing markets to raise capital and seek public listing embracing the new regime of Regulations A, A+, CF, D and S.

Raffles Capital Pte Ltd is also an oversight and governance supervisor for several funds that are based in Singapore under the new VCC (Variable Capital Company) structure. These funds are invested in the Asian carbon credit creation businesses and Pre-IPO equities.

Who Are We

Raffles Capital Pte Ltd is the holding company for Dr Charlie In and his family that hold significant shareholdings in Raffles Financial Group Limited (that provides corporate finance advisory and funding services and listed on Canada Securities Exchange stock code “RICH”), Apex Financial Group Limited (US incorporated firm that help firms raising funds via Reg A, A+, C, D and S), Victoria Financial Group Ltd (Hong Kong licensed firm that handles securities dealings, fund management and life and general insurance brokerage), Boustead Apex Inc (a Cayman company to be listed on the NYSE by September 2024) that provides public-listing and corporate advisory services for Asian firms). Raffles Capital Pte Ltd has minority interests in several public-listed and US private-equity platform listed companies.