Background

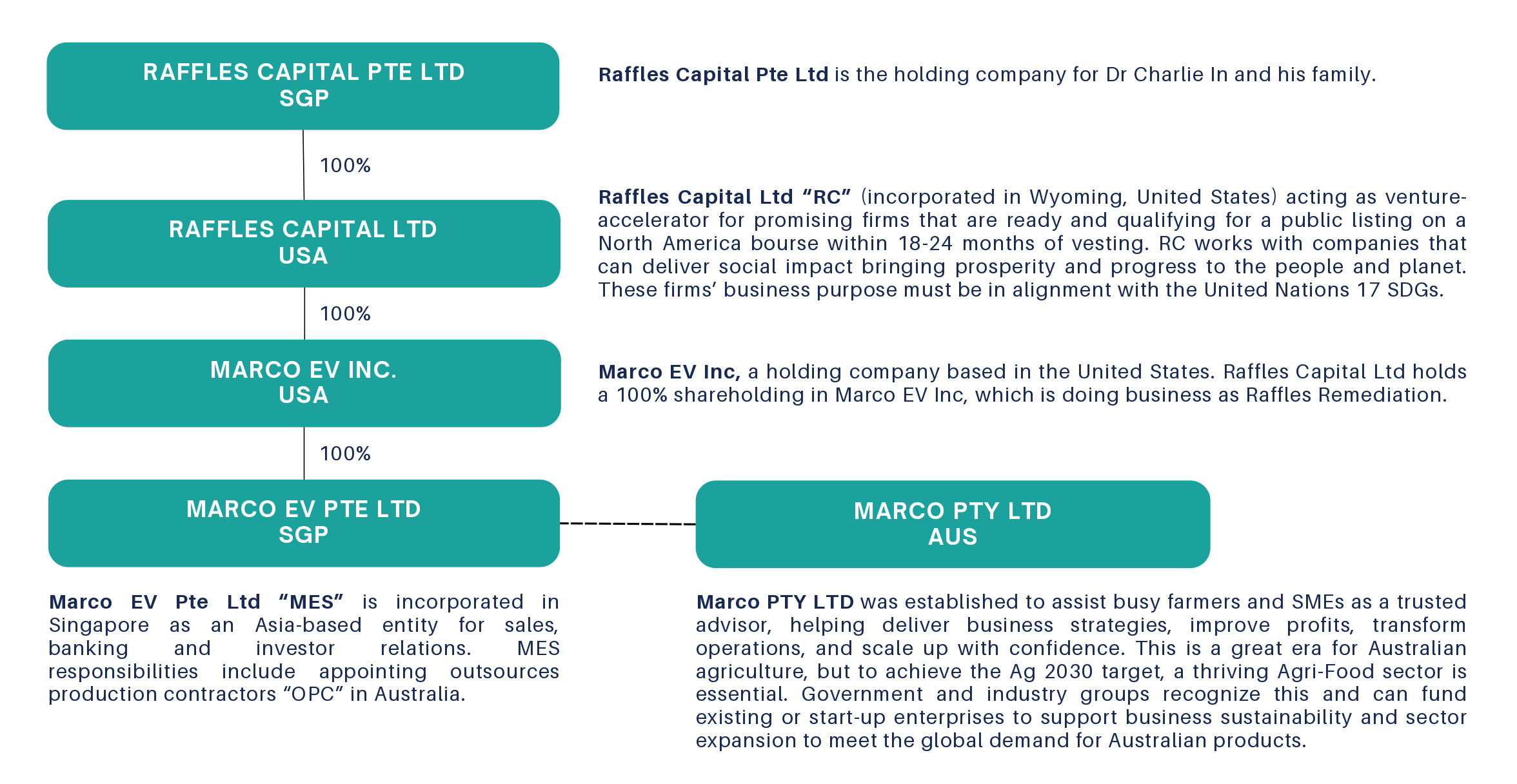

Marco EV Inc is working closely with Marco Pty Ltd, a recognized leader in Australia’s hemp industry, known for its rich history and diverse portfolio. They have achieved significant success in their ventures to date. Marco’s robust capabilities, extensive certifications, and proven track record position them as an ideal outsourced contractor, perfectly aligned with Marco’s strategic objectives.

A cornerstone of Marco’s business is its comprehensive portfolio of sustainable agricultural technologies and solutions. These projects encompass innovative farming techniques and sustainable food production systems, advancing global agricultural practices. By leveraging the expertise and infrastructure of partners like Marco, Marco ensures the rapid deployment of these solutions, minimizing capital expenditures and accelerating time-to- market.

By strategically focusing on sustainable agricultural development and inclusive community building, Marco contributes to the adoption of hemp’s nutritional and natural healing benefits, driving regional economic growth while addressing pressing global issues outlined by the SDGs. These include goals related to zero hunger, clean water and sanitation, decent work and economic growth, and responsible consumption and production. Marco’s commitment to ESG standards ensures that their projects not only drive economic progress but also promote environmental stewardship, social equity, and ethical governance

Asset-light strategy for rapid growth

Marco employs an asset-light strategy to maximize efficiency, reduce costs, and achieve rapid growth. This strategy involves leveraging the capacities, capabilities, and certifications of experienced partners like Marco Pty Ltd, allowing Marco to produce and sell finished products without significant capital expenditures or long lead times.

Key components of the asset-light strategy include:

Outsourcing Production

By contracting with Marco and other partners, Marco can quickly scale production to meet market demand without investing in costly infrastructure or equipment.

Minimizing Capital Expenditures

Leveraging existing facilities and resources of partners helps Marco avoid the substantial costs associated with building new production facilities, conducting extensive R&D, and maintaining large inventories.

Accelerating Time-to-Market

Utilizing the established processes and expertise of partners enables Marco to bring products to market faster, gaining a competitive edge and generating revenue more quickly.

Enhancing Cash Flow and Profitability

By reducing upfront costs and focusing on efficient production and sales, Marco can achieve positive cash flow and profitability sooner, ensuring financial stability and growth potential.