Welcome to the world of Habacoa

Bahamas most luxurious Residential community and North America’s Largest superyacht Marina

Surrounded by 20,000 acres of the Abaco National Park, a state-of-the-art marina, ultra-luxury resort and residential community is underway.

Land valued as-is at over $300 million in a 2024 appraisal conducted by Avison-Young and CRE Valuation Services.

*Appraisal report available to be reviewed at our discretion and subject to signing an NDA.Sail into the Heart of Bahamian Paradise

DIVE INTO A WORLD OF LUXURY AND SECLUSION:

Enjoy world class dining & shopping, live entertainment offerings, recreational water sports and beach experiences, bounded by the breathtaking beauty of the Bahamian seas.

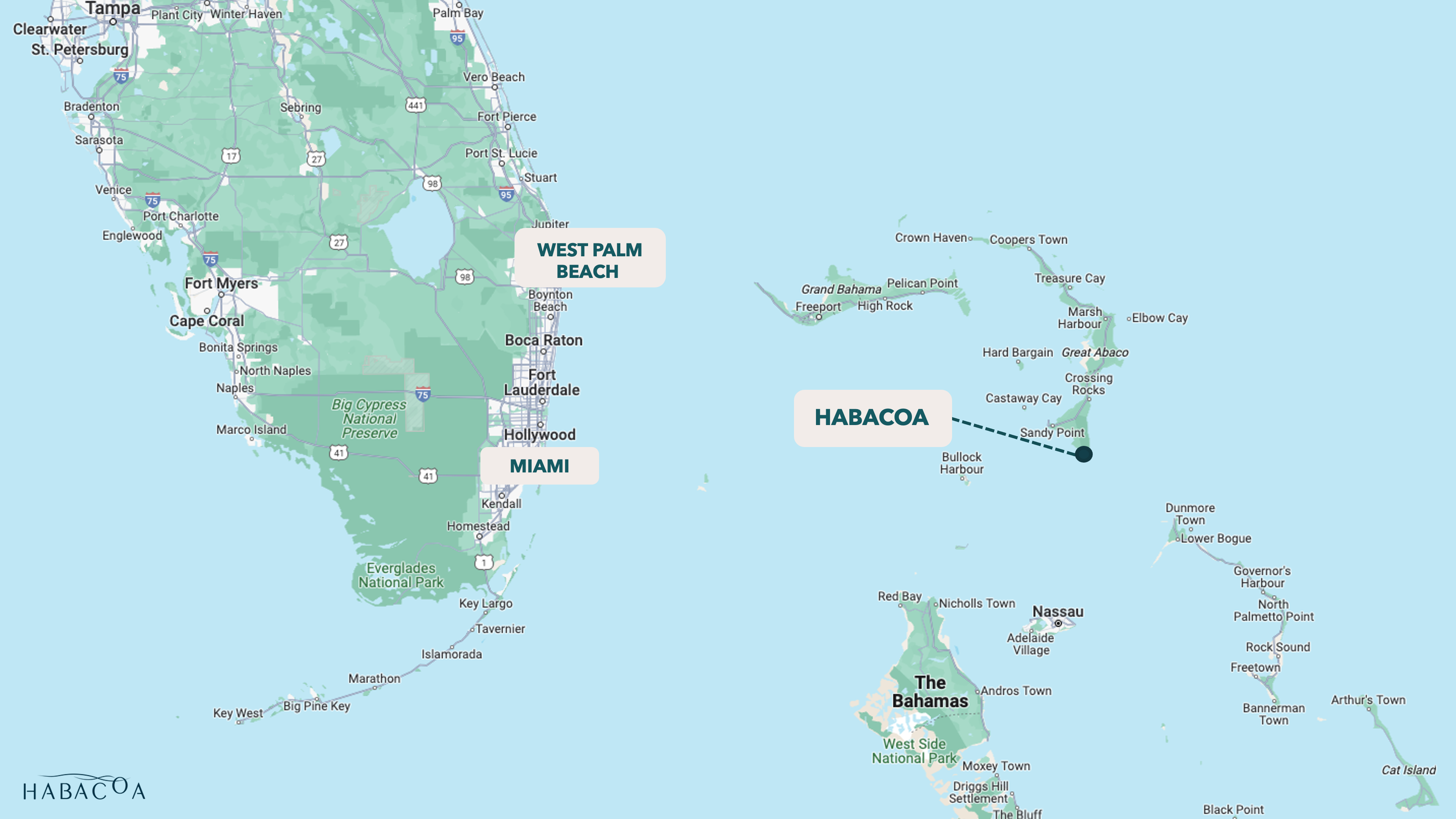

Habacoa: The Gateway to the Caribbean

Located at the southern tip of the Abaco Islands, Bahamas, Habacoa will offer easy accessibility by air and sea.

- By Air : Easy air accessibility, with a quick 30-minute flight from Miami and a 2-hour flight from New York.

- By Sea : Located on the main nautical route from the East Coast of the United States to the Bahamas, Caribbean, and South Atlantic.

- By Sport : From deep sea fishing in the abundance of the Great Bahama Canyon, bone fishing at the world-famous Abaco Marls, or plentiful fishing in the Berry Islands, it’s all a short sail away.

Status & Scope

Significant progress made over the past six years minimizes major project risks:

- Full Entitlement

- Environmental Approvals Granted

- Land Acquisition

- Prestigious Superyacht Agreement

Sustainability

Habacoa is designed with great care and responsibility to the pristine environment of South Abaco, while providing significant improvements to the infrastructure, and employment opportunities for the local community.

- Low Density: Habacoa will become one of the lowest-density communities in the Bahamas, with a mere 329 keys built across 506 sprawling acers. The low-density development will minimize the effects on the environment, protect open spaces, and preserve the original character of the land.

- Site Selection: Cliffs as high as 100 feet provide awe-inspiring vistas while ensuring the project will be protected from rising sea levels for the next 100 years and beyond. With its unique topography, Habacoa could withstand a direct hit from a hurricane with only minor damage expected.

- Clean & Renewable Energy: With 340 days of annual sunshine, Bahamian weather conditions are optimal for the generation of solar energy. Habacoa will incorporate state-of-the-art energy generation & storage technologies and has committed to using 30% solar power to meet the project’s energy needs.

- Preserving the Island's Ecosystem: Habacoa is committed to achieve La Belle Classe Destination classification and Blue Flag standards and establish the Marina as one of the most environmentally sustainable in the world.

Read Habacoa’s ESG Report to find out more.

*Designed by Zaha Hadid Architects, Rendering by FlyingArchitecture

*Designed by Zaha Hadid Architects, Rendering by FlyingArchitecture

*Designed by Zaha Hadid Architects, Rendering by FlyingArchitecture

*Designed by Zaha Hadid Architects, Rendering by FlyingArchitecture

*Designed by Zaha Hadid Architects, Rendering by FlyingArchitecture

*Designed by Zaha Hadid Architects, Rendering by FlyingArchitecture

To enhance the view, click on the above image.

To enhance the view, click on the above image.