About OPC

Founded in 2022, Omaha Phoenix Capital is a private equity firm based in Omaha, Nebraska. The firm seeks to invest in consumer-facing companies including technology, brands, gaming, retail, food, media, and the marketplace.

Omaha Phoenix Capital is a founder-led advisory group investing into Transformative, Disruptive, Business Models & Marketplaces.

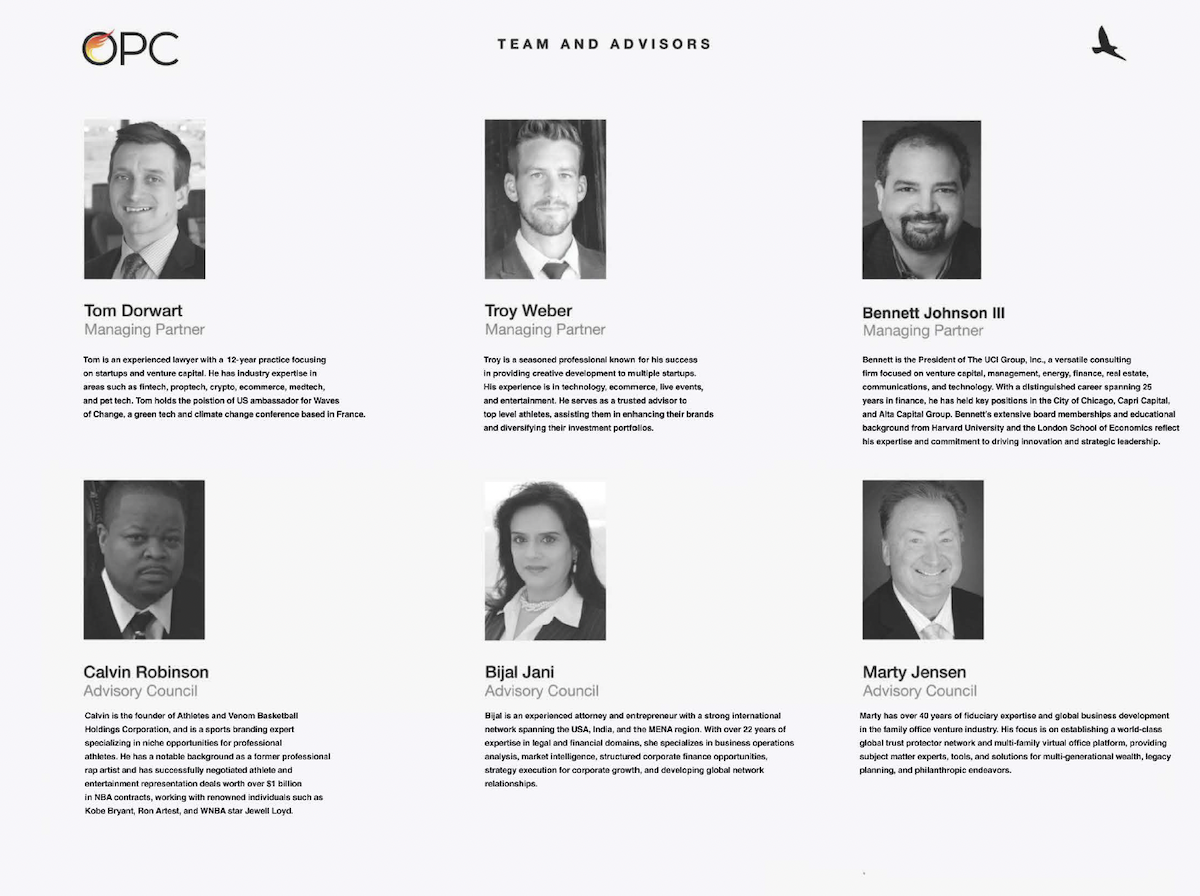

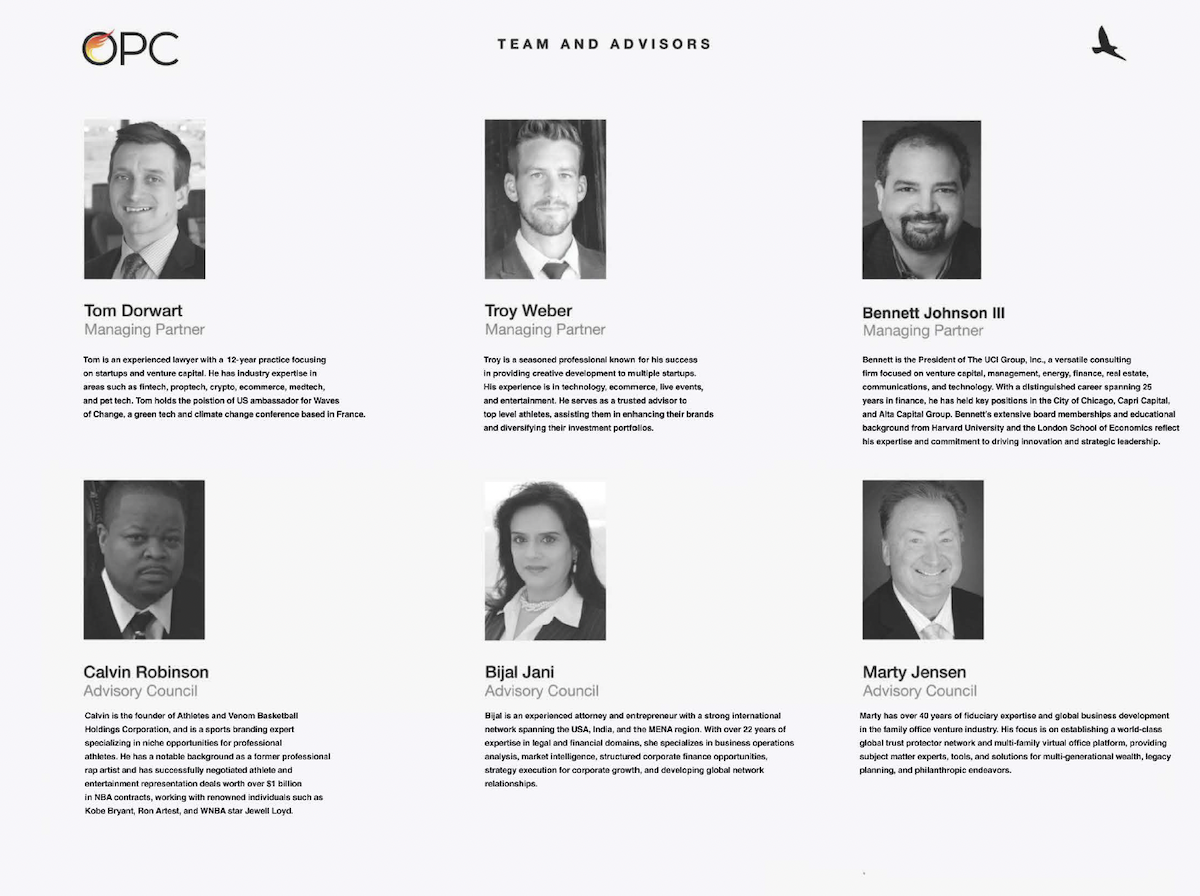

Our Team

TOM DORWART (MANAGING PARTNER)

Tom has practiced law for 11 years, with a particular focus on startups and venture capital for the past 7 years. He has been an advisor & assisted with large seed rounds for multiple startups that have been operating now for 10+ years since.

He advises over 40 startups and two venture capital funds. His industry experience ranges from fintech to proptech, crypto, ecommerce, medtech, and pet tech. Tom is the US ambassador and a team member for the green tech, climate change conference Waves of Change, based in France.

He is an advisor for the Emerging Fintech Forum, a fintech conference of emerging fintechs, & he speaks fluent French and is involved in the France ecosystem.

TROY WEBER (MANAGING PARTNER)

Troy has a proven track record of success within Business Operations & Creative Development. After obtaining his Bachelor’s Degree in Business Administration from Morningside University he managed full service hotels & promoted live music/boxing events.

Troy continues to work with well-known athletes as a trusted business partner & advisor. He is passionate about being at the forefront of new technology including digital assets & artificial intelligence. He loves working with founders to innovate & bring ideas to fruition.

BENNETT JOHNSON III (MANAGING PARTNER)

Bennett is the President of the UCI Group, Inc. a versatile consulting firm focused on venture capital, management, energy, finance, real estate, communications and technology.

With a distinguisshed career spanning 25 years in finance, he has held key positions in the City of Chicago, Capri Capital and Alta Capital Group.

Bennett's exstensive board memberships and educational background from Harvard University and the London School of Economics reflect his expertise and commitment to driving innovation and strategic leadership.

CALVIN ROBINSON (ADVISORY COUNCIL)

Calvin is the founder of Athletes & Venom Basketball Holdings Corporation. He is a sports branding expert that specializes in niche opportunities for various professional athletes. He works closely with major brands to find the right fit for their products.

He is a former professional rap artist and known for working with some of the most premier artist and NBA Players.

Calvin has helped negotiate athlete & entertainment representation opportunities for those who represented more than $1B in NBA Contracts.

Calvin handled off-court deals for Ron artest, Kobe Bryant, WNBA star Jewell Loyd, & more. Calvin is President of VL7 Sports Advisory & media platform.

He is President of the 3BA basketball league, VP of UBA Pro Basketball, & Principal of GSA Sports Advisors.

BIJAL JANI (ADVISORY COUNCIL)

Bijal is an experienced attorney and seasoned entrepreneur with an international network in USA, India, & MENA region.

Leveraging over 22 years of experience in the legal and financial arenas, she focuses on business operations analysis, market intelligence, structured corporate finance opportunities, strategy execution for real time corporate growth, & development of key global network relationships.

Bijal holds a Bachelor of Business Administration Degree in Public Accounting, a Juris Doctorate from Touro College, Jacob D. Fuchsberg Law Center, and Certification by University of Pennsylvania - Wharton School of Business on Entrepreneurship Financing & Profitability Specialization as applied to Venture Capital & Corporate Valuations.

Bijal is a proactive proponent for programs & organizations which focus on women empowerment, diversity, & gender equality.

MARTY JENSEN (ADVISORY COUNCIL)

Marty has over 40 years of fiduciary expertise with global business development in the family office venture industry. His career covers a broad range of advisory services dealing with multi-disciplinary, cross border, comprehensive wealth management programs.

He is building out a world-class global trust protector network and multi-family virtual office platform with subject matter experts and tools dealing with multi-generational wealth, legacy & philanthropic planning.

Marty is a former executive with EF Hutton / Morgan Stanley, Prudential-Bache / Wells Fargo Advisors, Midland Walwyn of Canada, ING Americas / Europe, Highland Capital, & Alliance Trust. In addition he is a former Managing Director of several broker dealer’s Wealth Management and Investment Banking units.